Info-Cafe

Results for : All categories

Results for : All categories

What Became Costlier After GST Roll-Out

You know that GST Council has finalized 4 categories of tax rate under GST regime i.e. 5 percent, 12 percent, 18 percent and 28 percent. Apart from this tax rate for Gold, Silver, Precious Stone and Processed Diamond is 3 percent and uncut rough Diamond would be taxed on 0.25 percent. GST Council has already rolled out different tax slab rate for 1211 items / things relating to consuming products and services. There are also certain items that have been completely tax exempted from GST regime; it is a boon for common man to run their livelihood easily. Huge products and services are came under 12% - 18% tax rate and out of that luxury and sin goods are comes under 28% tax rate. Yes, it will create a positive growth and development of a nation like India.

But we are talking about the things or goods that were less taxed earlier as compared to today’s tax rate under GST for the same items / products. So which products and services are became costly after GST rollout?

Let’s have a look on certain products and services that have increased their tax rate. Below is a comprehensive list of goods and services which would be costlier after GST implementation.

|

SL. No. |

Items-Things |

Old Tax Rate (%) |

GST Rate (%) |

|

1 |

Agarbatti |

0 |

5 |

|

2 |

Branded Paneer |

0 |

5 |

|

3 |

Branded Cereals |

0 |

5 |

|

4 |

Nuclear Fuel |

0 |

5 |

|

5 |

Heavy Water and Other Nuclear Fuels |

0 |

5 |

|

6 |

Compressed Air |

0 |

5 |

|

7 |

Solar Water Heater |

0 |

5 |

|

8 |

Renewable Energy Devices |

0 |

5 |

|

9 |

Butter, Ghee, Cheese |

6 |

12 |

|

10 |

Dry Fruits |

6 |

12 |

|

11 |

Jam, Jellies |

12 |

12 |

|

12 |

Frozen Meat |

6 |

12 |

|

13 |

Steam |

0 |

12 |

|

14 |

Children’s Drawing Books |

0 |

12 |

|

15 |

Fly Ash Bricks |

6 |

12 |

|

16 |

Preserve Vegetables |

0 |

18 |

|

17 |

Cell phones |

6 |

18 |

|

18 |

Telecom |

15 |

18 |

|

19 |

Coca Butter, Oils Chocolates |

26 |

28 |

|

20 |

Instant, Aroma Coffee |

26 |

28 |

|

21 |

Coffee Concentrates, Custard Powder |

26 |

28 |

|

22 |

Protein Concentrates, Sugar Syrups |

26 |

28 |

|

23 |

Razors |

26 |

28 |

|

24 |

Dental Floss |

26 |

28 |

|

25 |

Toothpaste |

26 |

28 |

|

26 |

Deodorants |

26 |

28 |

|

27 |

Aftershave |

26 |

28 |

|

28 |

Shaving Cream |

26 |

28 |

|

29 |

Leather Bags |

6 |

28 |

|

30 |

Yachts |

18.5 |

28 |

|

31 |

Air Conditioners |

26 |

28 |

|

32 |

Refrigerators |

26 |

28 |

|

33 |

Storage Water Heaters |

26 |

28 |

|

34 |

Dish Washing Machines |

26 |

28 |

|

35 |

Photo Copier, FAX Machines |

26 |

28 |

|

36 |

Wrist Watches |

26 |

28 |

|

37 |

Furniture |

26 |

28 |

|

38 |

Video Game Consoles |

26 |

28 |

|

39 |

Exercise Equipment |

26 |

28 |

|

40 |

Manicure, Pedicure Sets |

26 |

28 |

|

41 |

Perfumes |

26 |

28 |

|

42 |

Beauty or Makeup Preparations |

26 |

28 |

|

43 |

Skincare Items Including Sunscreen |

26 |

28 |

|

44 |

Shampoos, Hair Cream, Hair Dyes |

26 |

28 |

|

45 |

Wigs, False Beards, Eyelashes |

26 |

28 |

|

46 |

Stoves (Except Kerosene, LPG) |

18.5 |

28 |

|

47 |

Electrical Hot Plates |

18.5 |

28 |

|

48 |

Wall Paper |

18.5 |

28 |

|

49 |

Paints and Varnishes |

26 |

28 |

|

50 |

Putty, Wall Fillings |

26 |

28 |

|

51 |

Plaster |

26 |

28 |

|

52 |

Ceramic Tiles |

26 |

28 |

|

53 |

Tempered Glass |

26 |

28 |

|

54 |

Rubber Tyres |

18.5 |

28 |

|

55 |

Plastics Products |

18.5 |

28 |

|

56 |

Calcerous Stone |

18.5 |

28 |

|

57 |

Artists’ Students’ or Signboard Colours |

18.5 |

28 |

|

58 |

Pianos |

26 |

28 |

|

59 |

Revolvers |

26 |

28 |

|

60 |

Artificial Flowers |

26 |

28 |

|

61 |

Five Star Restaurants |

18 |

28 |

Related Posts:

Which items/products and services could get cheaper after GST rollout?

Claim Income Tax Refund: A Step by Step Guide

One of the first things that you need to do in order to claim your tax returns is file your income tax returns (ITR) for the year. Normally, the last date for filing tax returns in a year is July 31 and here you file the tax returns for the previous year. For an example, in this financial year (FY) 2018-19 you will be filing the tax returns in 2019-20, which will be regarded as the assessment year (AY).

A financial year is normally taken as April 1 of one year to March 31 of the next year and the assessment year is the just next year of financial year. For example, AY 2019-20 is the assessment year for FY 2018-19.

It is always better to avoid filing at the last time since there can always be mistakes with such an approach. Always file your returns several days before your deadline so that you do not have to face any undue issues.

All you need to know about income tax refund

The tax on your income over income tax slab needs to pay to the income tax department; after being exempted from all benefits and it is deducted from your annual income. So tax deducted at source (TDS) is a way to collect income tax from the source of your income. It is applicable to various source of income like salary, interest on bank FDs, professional fees/ technical fees, rent of land & building and more.

However, TDS is not the final tax amount that you need to pay to the income tax department; your actual tax liability may be higher or lower after tax calculation. So therefore, if the total TDS deducted during a financial year is greater than the actual tax obligation, then you can make a request for refund of excess TDS that deducted over and above your tax liability.

For an instance, if your total TDS is deducted from a financial year was Rs. 40,000, but at the time of filing the income tax return your actual tax liability is ascertained to be Rs. 15,000 only, then you can claim to receive the income tax (TDS) refund of Rs. 25,000.

Keeping all the necessary papers close by

Before you start the process of filing reports it is important that you have your important papers with you. This would items such as the following:

- salary statements

- bank statements

- business income statements

- Form 16 from your employers

- Form 16 from your banks where you have made investments

- certificates of interest that you have paid

- proofs of investment and related documents

- insurance documents that may be relevant

- 26AS tax credit extract

The business income statements are however applicable only if you have a business as such.

Filing the income tax

The next step is filing the ITR. You can do this by filing either ITR-1 or ITR-4 form. The form contains a number of fields that are important for this purpose. Some of them may be mentioned as below:

- name

- address

- your complete income

- the income that is liable to be taxed

- taxes deducted at source (TDS) if any

- total dues

- refund due

This form would contain all your financial data for an assessment year. You can fill this form by yourself or take the help of a tax lawyer or chartered accountant if you wish to. The form basically explains itself and this is why you can easily fill it.

How to claim TDS refund

To claim the TDS refund you need to file income tax return (ITR) in the relevant assessment year (AY). The last date of filing ITR is normally 31st July of relevant assessment year.

At the time of filing ITR what information you have provided, the refund amount would be displayed on the screen automatically under the “Refund” row option. Once the I-T Department processes your ITR, verifies its genuineness and accepts it, then you’ll be intimated by them.

Intimation under Section 143 (1) is given to the taxpayer which may say, ‘tax calculation matched with I-T Department’, ‘tax calculation not matches with I-T Department’ or ‘calculation matches with I-T Department and refund claim accepted’.

If you filed your ITR online and have registered mobile number with I-T Department, then you may get intimation through SMS about the processing of ITR.

You will be asked to provide details of the bank account in which you would like to get the refund if you are filing it in online. The refund amount will be credited to your account once the assessment cycle is over for the I-T Department. And for offline refunds a cheque will be issued in the taxpayer’s name.

Identifying the amount to be refunded to you

Once you have submitted the form, you will be able to see the refund in the refund column. This would happen only in case you have paid more taxes than you are supposed to. If you wish to identify this sum you would need to click on the button named validate, which is there on the sheet named taxes paid and verification. Over there, you would need to note the refund amount and also keep a copy of the ITR form thus generated.

You can check the total TDS deducted amount during the financial year by viewing the "Form 26AS". Form 26AS consists of all TDS deducted by the deductor such as bank accounts, employer, tenant etc. You can access the Form 26AS by logging into e-filing portal of Income Tax Department and view it online and can download the same in PDF format.

Sending the form to the income tax office

If a figure is actually shown in the refunds column then it means that you have actually paid more taxes than your actual liability.

In order to claim the refund, you would need to take a print out of that form and then sign at the place where you are supposed to. The form also has the address of the income tax office – it is there where you would have to send the form. The form can be sent through ordinary post or speed post. After this you need to enclose the form, put it in an envelope and then send it to the specified address.

Interest on TDS refund

If the taxpayer files the ITR with a claim for refund of TDS before July 31st of the relevant assessment year, then the taxpayer is entitled to receive the interest on refund amount for the period starting from 1st April of relevant AY to the date on which refund is granted.

If the return is filed after 31st July of the relevant assessment year, then the interest is calculated from date of filing ITR to the date on which refund is granted.

Currently interest rate at 6% per annum is given on the refund amount. Interest received on the refund is taxable and it is added in the gross income of the taxpayer for that financial year in which interest is received.

How long the refund takes

This is the final stage. After Income Tax Department gets the signed on it, you would be informed by way of SMS (short message service) or email. It would definitely verify the figure in case it finds something wrong with it.

However, as soon as they are okay with the data that you have furnished the application would be processed and the extra taxes that you have paid would be refunded to you. Throughout the entire process you would keep receiving communication from the Income Tax Department by way of SMS or e-mail.

It depends upon whether the TDS is given on online or through cheque, it normally takes two weeks to three months of time from date of verification of ITR to get the TDS refund. For those who have filed it after first deadline, it may take longer for them.

---------------------------------------------------------

Related Posts:

You Must Know About Professional Tax in India

Know about Chartered Accountant Services in Bangalore

Annual Filing Return for Companies under the Compliance of 2013

Why Bangalore is a good place for business?

There are some good reasons as to why investors are so keen on putting their money in Bangalore. This district with a population of 9.6 million people has a glorious history of technological innovations. The city has a fantastic network of support for entrepreneurs, who are willing to become parts of the growth story that is Bangalore. The ecosystem over here is throbbing with life and presents everyone a chance to do well. Bangalore has had a rich history of being a tech capital even long before internet and companies working with such technology came along. It was at the capital city of Karnataka that the first-ever Indian Institute of Science was established more than a century back – in 1909.

Contributions made by Bangalore

Ever since, Bangalore has made sterling contributions in domains such as advanced computing, nuclear technologies, and space. This means that when as an investor you try and set up shop in Bangalore you can be sure that you will have enough local talent willing to work productively to make your dream a reality. As has been said already, there is more-than-enough support for business entrepreneurship in this capital city of Karnataka. There are bodies such as the UK Indian Business Council (UKIBC) that have been pumping in significant amounts of money in the city’s business ecosystem.

Utilization of funds

The money derived from the programme is expected to be used for support services such as the following:

- mentoring

- policy insight

- training

- expertise in market entry

- networking events

- market research

There are certain areas such as Koramangala where the business infrastructure in Bangalore is really strong. Here you will find that the ecosystem for small businesses is really good. Here they can get all the help that they need in order to fulfill their true potential and also gain exposure to markets around the world.

Help coming in from other countries

Countries such as the United Kingdom have been making the most of the potential on offer in the startup scenario in Bangalore. They are associating with the state government of Karnataka to provide funding for new business enterprises by way of the Karnataka Information Technology Venture Capital Fund (KITVEN Fund). Other investors such as incubators, angel investors, and venture capital funds are also coming to the city in droves to partake in the growth of the city’s economy. They are all looking for the best investment opportunities – ones that the city is known to provide.

Networking opportunities

As may be gauged from a business ecosystem as busy as the one in Bangalore there are plenty of networking opportunities to be had. The business culture in this city is also second to none as can be understood from the words of Ian Felton, the Deputy High Commissioner of Great Britain in Bangalore, the city in future is going to be one of the faces of the country. It has a high-tech society that is truly cosmopolitan and has a global outlook to boot.

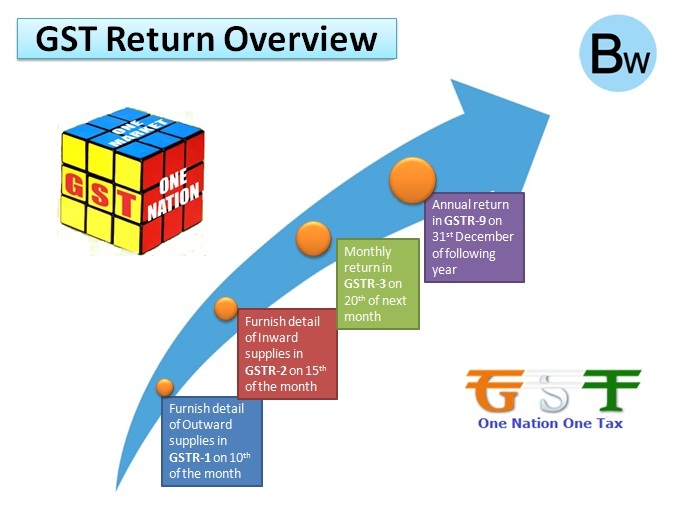

GST Return: Types of Forms in GST Returns and their Due Date

GST (Goods and Services Tax) return is a record of invoices for supply and receives of goods and services during the business process. Under the Indian GST law, a normal taxpayers, composition taxpayers, casual taxpayers, non-resident taxpayers, TDS Deductors, Input Service Distributors (ISDs) have to file certain returns electronically by different class of persons with different cut-off dates. The return mechanism is designed to assist taxpayers to file returns and avail Input Tax Credit (ITC).

ITC (Input Tax Credit) can available only on provisional basis for a period of two months until payment of tax and filing of valid return by the supplier. Credit of returns can available from supplier to recipient, in case of matching information at invoice level otherwise ITC to be reverse in case of mismatch. Receiving credit will help to fight for huge evasion of taxes.

Under GST, a regular taxpayer needs to furnish monthly returns and one annual return. For composition taxpayer should have to file Quarterly returns. Likewise, there are separate returns for a taxpayer who is registered under GST as non-resident taxpayer, taxpayer registered as Input Service Distributors (ISDs), a person liable to deduct or collect the tax (TDS/TCS) and a person granted Unique Identification Number. A taxpayer need not file all the types of returns. As a matter of fact, they are required to file returns according to the activities of their business.

All the GST matters are to be filed through online. If you need our assistance on GST registration in Bangalore, Karnataka we will be glad to complete all your GST return process to avoid penalties relating to returns and get tax benefit or GST Returns can be done by filing anyone of the following methods:

- By GSTN Portal (www.gst.gov.in)

- By Offline utilities provided by GSTN

- By GST Suvidha Providers (GSPs) – If you are already using the services of ERP providers such as Tally, SAP, Oracle etc., there is a high likelihood that these ERP providers would provide inbuilt solutions in the existing ERP systems

Here you can follow the table list on various types of returns, due date and forms under GST Law:

|

Returns Form |

Description |

Who Liable to File |

Due Date for Filing |

|

GSTR-1 |

Monthly Statement of Outward supplies of Goods or Services |

Registered Person |

10th of the next month |

|

GSTR-2 |

Monthly Statement of Inward supplies of Goods or Services |

Registered Person |

15th of the next month |

|

GSTR-3 |

Monthly Return for a normal taxpayer |

Registered Person |

20th of the next month |

|

GSTR-4 |

Quarterly Return |

Taxable Person opting for Composition Levy |

8th of the month succeeding the quarter |

|

GSTR-5 |

Monthly Return for a non-resident taxpayer |

Non-resident taxpayer |

20th of the month |

|

GSTR-6 |

Monthly Return for an Input Service |

Input Service Distributor |

13th of the next month |

|

GSTR-7 |

Monthly Return for authorities deducting tax at source |

Tax Deductor |

10th of the next month |

|

GSTR-8 |

Monthly Statement for E-Commerce Operator depicting supplies effecting through it |

E-Commerce Operator |

10th of the next month |

|

GSTR-9 |

Annual Return |

Registered Person other than an ISD, TDS/TCS Taxpayer, Casual Taxable Person and Non-resident Taxpayer |

31st December of next financial year |

|

GSTR-10 |

Final Return |

Taxable Person whose registration has been surrendered or cancelled |

Within 3 months of the date of cancellation or date of order of cancellation whichever is later |

GST Filing Process

GST filing is easy and simple process but have to through proper way. A normal taxpayer has to file the following returns:

GSTR-1 (Statement of Outward Supplies):

- This return signifies the tax liability of the supplier for the supplies effected during the previous month.

- It needs to be filed by the 10th of every month in relation to supplies effected during the previous month. For example, a statement of all the outward supplies made during the month of July 2017 needs to be filed by 10th August, 2017.

GSTR-2 (Statement of Inward Supplies):

- This return signifies accumulation of ITC (Input Tax Credit) from the inputs received during the previous month.

- It is auto-populated from the GSTR-1s filed by the corresponding suppliers of the Taxpayer except for a few fields like imports and purchases from unregistered suppliers.

- It needs to be filed by the 15th of every month in relation to supplies received during the previous month. For example, a statement of all the inward supplies received during the month of July 2017 needs to be filed by 15th August, 2017.

GSTR-3: This is a consolidated return. It needs to be filed by the 20th of every month. It consolidates the following details

- Outward Supplies (Auto-Populated from GSTR-1)

- Inward Supplies (Auto-Populated from GSTR-2)

- ITC availed

- Tax Payable

- Tax Paid (Using both Cash and ITC)

- Payment should be made on or before 20th of every month.

Annual Return:

GST annual return needs to be filed by 31st December of the next Financial Year. In this return, the taxpayer needs to furnish details of expenditure and details of income for the entire Financial Year.

GST (Goods & Services Tax) is a Boon for Household Items

Goods and Services Tax (GST) is economic freedom from cascading and complicated tax regime. GST will bring in not only transparency but also economic integration. And economic integration will strengthen the national integration. This is the larger objective of GST Council.

The goods and services tax (GST) is a radical step towards the country’s transformation into a common market. GST is applicable mainly for manufacturer, service provider and trader. In other word we can say GST is applicable for businesses and won’t affect directly to the salaried class, self-employed professionals and mostly for normal people.

So common man can take the benefits of GST, these people have no worry about the implementation of goods and services tax. It will drive their live better; GST is helpful for household items which are used regularly by common man. I think a single tax can bring down prices for most households.

Here you can see the different categories of tax rates on various items that we are using regularly in our day-to-day life.

Goods and Services Tax (GST) @ 0%

- Unpackaged Food Grains

- Fresh Vegetables

- Unbranded Atta

- Unbranded Maida

- Unbranded Besan

- Gur

- Milk

- Eggs

- Curd

- Lassi

- Unpackaged Paneer

- Unbranded Natural Honey

- Palmyra Jaggery

- Salt

- Kajal

- Phool Bhari Jhadoo

- Children’s Drawing and Colouring Books

- Education Services

- Health Services

Goods and Services Tax (GST) @ 5%

- Sugar

- Tea

- Roasted Coffee Beans

- Edible Oils

- Skimmed Milk Powder

- Milk Food for Babies

- Packed Paneer

- Cashew Nuts

- Raisin

- PDS Kerosene

- Domestic LPG

- Footwear (upto Rs. 500)

- Apparels (upto Rs. 1000)

- Agarbatti

- Coir Mats

Goods and Services Tax (GST) @ 12%

- Butter

- Ghee

- Almonds

- Fruits Juice

- Packed Coconut Water

- Preparation of Vegetables, Fruits, Nuts or other parts of Plants including Pickle, Murabba, Chuntey, Jam and Jelly

- Umbrella

- Mobiles

Goods and Services Tax (GST) @ 18%

- Hair Oil

- Toothpaste

- Soap

- Pasta

- Corn Flakes

- Soups

- Ice-Cream

- Toiletries

- Computers

- Printers

Really GST will helpful to integrate the nation’s economic growth and development by binding a single thread of tax system in all over the India.

-----------------------------------------------------------------------

Related Posts:

GST Brings Benefits for All

GST becomes a reality today. Building a new India through One Nation, One Tax and One Market.

GST is a good and simple tax. It is a tax for new India, a digital India. It doesn’t just promote easy of doing business but also show the way forward as a way of doing business.

How GST will get helpful for all? See brief information is given below:

Common Man Friendly:

- Huge number of items are either tax exempt or in 5% tax bracket.

- Maximum benefits to the poor and the common man.

- Will ensure that the poor get their due.

- Level playing field for small traders in any part of the country.

Advantages for Trade and Industry:

- Common procedures for registration, duty payment, return filing and refund of taxes.

- Seamless flow of tax credit from manufacture / supplier to user / retailer to eliminate cascading of taxes.

- More efficient neutralization of taxes to make our exports more competitive internationally.

- Benefit of exemption / composition of scheme for a large segment of small scale suppliers to make their products cheaper.

Benefits to Economy:

- To create a unified common National market.

- To make India a manufacturing hub.

- To boost investments and exports.

- To generate more employment by increased economic activity.

Simplified Tax Structure:

- Reduction in multiplicity of taxes now levied on goods & services, leading to simplification.

- Simpler tax regime with fewer exemptions.

- Harmonization of laws, procedures and rates of tax across the country.

- Common system of classification of goods & services to ensure certainty in tax administration.

Creating One Economic India:

- Freedom of movement of goods and services.

- Consumers to benefits by increased competition.

- Level playing field for producers and consumers across the country.

- Strengthening the sense of nationhood and unity.

GST is not only for goods and services tax but also a good and simple tax really.

You can have check out our previous articles based on Goods and Services Tax (GST) in below

--------------------------------------------------

Related Posts:

GST Council Finalizes the Rates for Goods and Services

GST Council Finalizes the Rates for Goods and Services

The two-day GST Council meeting held in Srinagar on May 18-19, 2017, saw participation from states and union territories along with Shri Arun Jaitley and senior officials from the revenue department.

An officers’ panel over the last six weeks had been working towards the fitment and classification exercise – an exhaustive list specifying the tax rate of goods and services, which was presented at the council meeting.

The Council had earlier agreed on a four broad slab structure i.e. 5, 12, 18 and 28 percent. The GST Council meet saw final conclusion on the rates of goods and services under Goods & Services Tax regime.

Few key takeaways include:

Tax on GOODS:

- 81% items out of 1211 items, to be taxed at below 18% under GST

- A list of 7 per cent of the total 1,211 items has been exempted, 14 per cent of the items are in the 5% tax slab, and 17 per cent of total items are 12% tax slab. About 43 per cent of the items will attract 18% tax rate, while only 19 per cent will be in the 28% tax slab.

- Milk, cereals (unpackaged and unbranded), food grains, fruits, vegetables and jaggery to be exempt

- Items like “Puja Samagri” shall be subject to nil rate of GST

- Normal sugar, tea, coffee and edible oil and coal have been placed in the 5% tax slab

- Medical devices, smartphones to be subjects to 12% tax slab

- Soap, toothpaste, hair oil, chemicals will be taxed at 18%

- Consumer durables, packaged cement to attract 28%

- Footwear under Rs. 500 will be taxed at 5% and all other types would be taxed at 18%

- Tendu leaves will be taxed at 18% while bidis will be taxed at 28%

- Biscuits would be taxed at 18%

- Solar panel to be taxed at 5%

- Gold, silver and processed diamond to be taxed at 3% while rough diamond would be at 0.25%

- Two slab rate for agriculture equipment i.e. 5% and 12%

- The textile industry sources to be taxed at 5% under GST

Tax on SERVICES:

- Healthcare and education services to be exempt

- 5 % on car aggregators like OLA and UBER as well as advertisements

- Rail, road and air transport to be taxed at 5%

- Telecom insurance and financial services to be taxed under 18%

- Tax on services like 5 star hotel, race club betting and cinema to be 28%

GST Council also approved rule relating to Registration, Refund, Payment, Valuation, Composition, Invoice and Input Tax Credit.

GST Updates on Proper Fitment of Products Based on Actual Tax

The goods and services tax bill (GST Bill) is expected to be introduced pretty soon. As such the GST Council is now looking to meet during May 2017 in order to decide the rates of each item. The two systems that are to be taken into account for this purpose are Service Accounting Codes (SAC) and Harmonised System of Nomenclature (HSN). The GST Council has finalized four tiers of taxation to be imposed on goods. They are 5 per cent, 12 per cent, 18 per cent, and 28 per cent. It is being said that bulk goods are expected to be taxed at 12 per cent and 18 per cent.

Rate of taxation

The lowest category of 5 per cent is expected to be applied for essential goods while luxury goods will be subjected to the highest slab of 28 per cent. Along with this, an additional cess is expected to be levied on goods like luxury cars, pan masala, tobacco products, and aerated drinks. As of now, the different industries are waiting with bated breath to see which category they are slotted in. Once they get to know about the said categories they would be in a better position to take stock of the effects that the new tax structure would have on them. All this data is going to be crucial with respect to GST registration.

How is government seeing the situation?

From the information that has come through the public domain the effect of the new taxes is not going to be too different than what is the case with the present tax structure. However, this is always going to be easier said than done. If we are to understand how government’s thought process will be translated to reality it is necessary to understand the effects of the present tax regime on various products. At present, a lot of goods are subjected to a value added tax (VAT) of 14 per cent and excise duty of 12.5 per cent. Will this have any effect on GST registration in Bangalore?

The effects of present tax regime on goods

If you add those two categories it comes to 26.5 per cent and it is expected that these goods will now be classified under the highest bracket of 28 per cent under the new goods and services tax regime. However, if goods were fitted into higher rates just by adding the value added tax rates and excise rates then the goods and services rates that we arrive at would be distorted to say the least. There is a chance that tax incidence in actuality could be lower than what is apparent now as far as GST in India is concerned.

Reasons for lower tax incidence

GST registration in Karnataka is expected to get smoother than before. One of the major reasons for a possible lower tax incidence is that excise rates could go down in the future. More important than this is the fact that the same good may be subjected to different rates of value added taxes in various states.

Chartered Accountant Services in Bangalore

The top chartered accountant service providers in Bangalore operate as firms. In most cases it is seen that these organizations have been in the business for a significant period of time. This means that they have gathered sufficient experience in their line of work and know what they are doing. They have dabbled in a wide variety of services at the same place for a lengthy period of time and thus they can help you no matter how good or bad your situation is. There are always certain areas in which these organizations tend to specialize. Some of those areas may be mentioned as below:

- back office management services

- audit and assurance

- direct and indirect taxation

- international taxation

- corporate law

- management consultancy

- matters related to the Foreign Exchange Management Act

- mergers and acquisitions

Industry-wide experience

The providers of chartered accountant services in Bangalore operate in various industries that can be as similar as chalk and cheese. This means that on a regular basis they are being exposed to various situations and predicaments, and they have thankfully been able to come out of those with flying colours. This also augurs well for you as a prospective client.

Helping you always

This implies that you can be from any industry and you can be facing any kind of problem. You can be sure that when you come to a chartered accountant in Bangalore it will surely help you. These organizations operate as per simple principles – of providing the best-possible solutions for the issues being faced by the clients. The business environment has become quite dynamic now and everyday new challenges are coming up. With the help of these companies you would always be in a better position when it comes to facing such challenges and dealing with them in an effective manner.

Talent and overall way of work

The companies that provide CA services in Bangalore Karnataka normally work with the very best professionals in the industry. This is one reason they are able to deliver the kind of service that they are known for. They are always well served in terms of the people that are working for them. These companies normally use the best and latest – cloud based in this case – accounting, customer relationship management, and payroll software. These software tools are used all over the world. These companies also cater to international clients that can be from countries such as the following:

- The United States of America

- France

- The United Kingdom

- The Netherlands

- Spain

- Hungary

- Taiwan

- Singapore

- China

- Japan

- Romania

- Switzerland

- Suriname

- South Africa

These companies always aim to provide services that cannot be matched in terms of quality and are delivered at the time that they are contractually obligated to do. They believe in a never-ending cycle of sharing knowledge with their clients in order to empower them. They always make their best efforts in order to make sure that they are adding value to their clients.

------------------------------------------------------

Also Read:

All You Need to Know About Professional Tax in India