GST Return: Types of Forms in GST Returns and their Due Date

Posted on: 2017-07-19 07:40:38

GST (Goods and Services Tax) return is a record of invoices for supply and receives of goods and services during the business process. Under the Indian GST law, a normal taxpayers, composition taxpayers, casual taxpayers, non-resident taxpayers, TDS Deductors, Input Service Distributors (ISDs) have to file certain returns electronically by different class of persons with different cut-off dates. The return mechanism is designed to assist taxpayers to file returns and avail Input Tax Credit (ITC).

ITC (Input Tax Credit) can available only on provisional basis for a period of two months until payment of tax and filing of valid return by the supplier. Credit of returns can available from supplier to recipient, in case of matching information at invoice level otherwise ITC to be reverse in case of mismatch. Receiving credit will help to fight for huge evasion of taxes.

Under GST, a regular taxpayer needs to furnish monthly returns and one annual return. For composition taxpayer should have to file Quarterly returns. Likewise, there are separate returns for a taxpayer who is registered under GST as non-resident taxpayer, taxpayer registered as Input Service Distributors (ISDs), a person liable to deduct or collect the tax (TDS/TCS) and a person granted Unique Identification Number. A taxpayer need not file all the types of returns. As a matter of fact, they are required to file returns according to the activities of their business.

All the GST matters are to be filed through online. If you need our assistance on GST registration in Bangalore, Karnataka we will be glad to complete all your GST return process to avoid penalties relating to returns and get tax benefit or GST Returns can be done by filing anyone of the following methods:

- By GSTN Portal (www.gst.gov.in)

- By Offline utilities provided by GSTN

- By GST Suvidha Providers (GSPs) – If you are already using the services of ERP providers such as Tally, SAP, Oracle etc., there is a high likelihood that these ERP providers would provide inbuilt solutions in the existing ERP systems

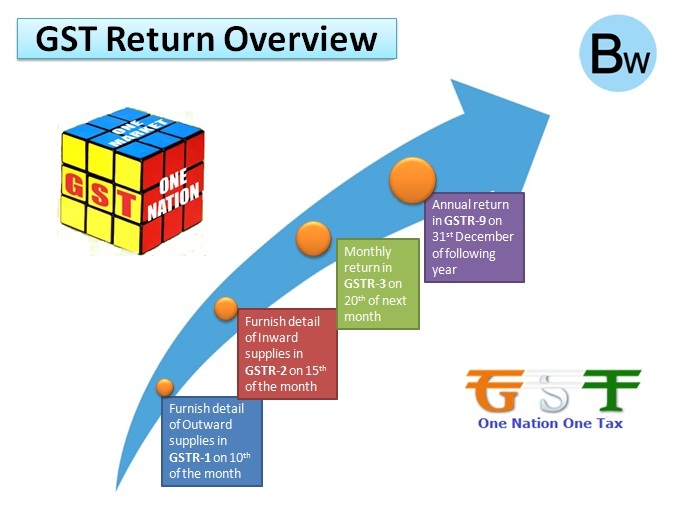

Here you can follow the table list on various types of returns, due date and forms under GST Law:

|

Returns Form |

Description |

Who Liable to File |

Due Date for Filing |

|

GSTR-1 |

Monthly Statement of Outward supplies of Goods or Services |

Registered Person |

10th of the next month |

|

GSTR-2 |

Monthly Statement of Inward supplies of Goods or Services |

Registered Person |

15th of the next month |

|

GSTR-3 |

Monthly Return for a normal taxpayer |

Registered Person |

20th of the next month |

|

GSTR-4 |

Quarterly Return |

Taxable Person opting for Composition Levy |

8th of the month succeeding the quarter |

|

GSTR-5 |

Monthly Return for a non-resident taxpayer |

Non-resident taxpayer |

20th of the month |

|

GSTR-6 |

Monthly Return for an Input Service |

Input Service Distributor |

13th of the next month |

|

GSTR-7 |

Monthly Return for authorities deducting tax at source |

Tax Deductor |

10th of the next month |

|

GSTR-8 |

Monthly Statement for E-Commerce Operator depicting supplies effecting through it |

E-Commerce Operator |

10th of the next month |

|

GSTR-9 |

Annual Return |

Registered Person other than an ISD, TDS/TCS Taxpayer, Casual Taxable Person and Non-resident Taxpayer |

31st December of next financial year |

|

GSTR-10 |

Final Return |

Taxable Person whose registration has been surrendered or cancelled |

Within 3 months of the date of cancellation or date of order of cancellation whichever is later |

GST Filing Process

GST filing is easy and simple process but have to through proper way. A normal taxpayer has to file the following returns:

GSTR-1 (Statement of Outward Supplies):

- This return signifies the tax liability of the supplier for the supplies effected during the previous month.

- It needs to be filed by the 10th of every month in relation to supplies effected during the previous month. For example, a statement of all the outward supplies made during the month of July 2017 needs to be filed by 10th August, 2017.

GSTR-2 (Statement of Inward Supplies):

- This return signifies accumulation of ITC (Input Tax Credit) from the inputs received during the previous month.

- It is auto-populated from the GSTR-1s filed by the corresponding suppliers of the Taxpayer except for a few fields like imports and purchases from unregistered suppliers.

- It needs to be filed by the 15th of every month in relation to supplies received during the previous month. For example, a statement of all the inward supplies received during the month of July 2017 needs to be filed by 15th August, 2017.

GSTR-3: This is a consolidated return. It needs to be filed by the 20th of every month. It consolidates the following details

- Outward Supplies (Auto-Populated from GSTR-1)

- Inward Supplies (Auto-Populated from GSTR-2)

- ITC availed

- Tax Payable

- Tax Paid (Using both Cash and ITC)

- Payment should be made on or before 20th of every month.

Annual Return:

GST annual return needs to be filed by 31st December of the next Financial Year. In this return, the taxpayer needs to furnish details of expenditure and details of income for the entire Financial Year.