How to Apply for MSME Registration in Bangalore Karnataka?

Posted on: 2018-06-07 05:59:35

These days, there are several reasons as to why a number of small and medium enterprises (SMEs) are being formed in Karnataka as well as other parts of the country. You can be considered eligible for lower rates of interest on loans, you can get subsidies on power tariffs and tax subsidies, and you can become a part of capital exemption schemes and receive capital investment subsidies as well. You can also be granted exemptions from direct tax laws.

These days, all the states and union territories in India have their own special packages whereby they provide incentives and facilities for the small scale companies.

There are some other benefits of forming such a company as well. They need a very short period as far as conceptualization is concerned. They are mainly labor intensive, which is available abundantly and for cheap in India.

As far as decentralization of power is concerned they are great indeed. All the benefits that accrue to an SME come through the MSMED Act that has been passed by the Government of India. And its registration is free of cost, no need to pay any fees to Ministry of MSME department; but it is very important to be registered as an MSME in order to get the special benefits from central and state government of India. This is an initiative program of govt. to accelerate and promote the easy of doing business.

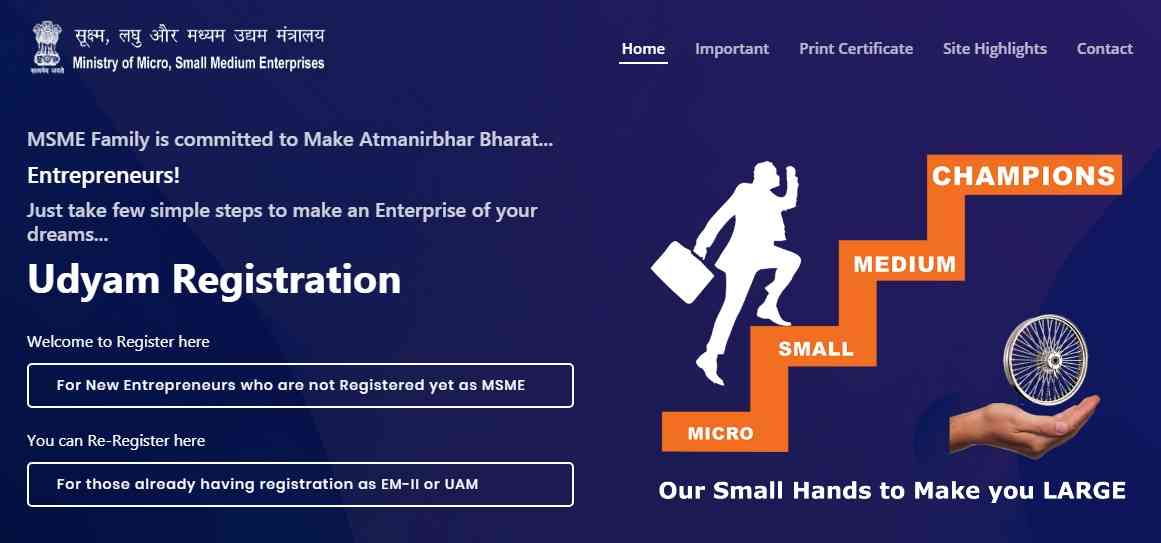

So, the thing is that where to register your enterprise? For this, you need to do registration of your enterprise in Udyam Registration official website which regarded as the MSME registration portal of government of India. And it is also known as Udyog Aadhaar registration gateway for micro, small & medium sized enterprises.

We highly recommend going with this site for doing registration of any enterprise is the right way to get advantages under MSME Act.

In this article, we discuss the following important points on MSME:

- What is MSME?

- Classification of MSME

- Investment Limits of Enterprises in India

- Importance of MSME in India

- Why an Enterprise Needs MSME Registration?

- Benefits of Registering an Enterprise under MSME Act.

- Documents Required for MSME Registration in Bangalore India

- How to Get the MSME Certificate?

- MSME Certificate Validity Period

- MSME Registration Process (a step-by-step procedure for getting the instant certificate through online)

- Verify UAM Status Online

- Print Udyam Certificate

- Edit or Update Udyog Aadhaar

What is MSME Enterprise?

MSME means the enterprises or industries that’s stands for Micro, Small and Medium Enterprises, as the name indicates that it includes with the enterprises which may be a medium level or below medium level or below to below medium level with respect to their terms of productions, services and investment towards the business goal.

According to the provision of Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 the MSME is classified into two classes such as

- Manufacturing Enterprises

- Service Enterprises

As stated by the Ministry of Micro, Small & Medium Enterprises department, manufacturing and service based industries are required to invest capital on plant & machinery and equipment head.

Therefore, the manufacture industries are defined as in terms of investment in plant & machinery where as the service provider industries are defined as in terms of investment in equipment.

So, here take an overview on the conditions for investment in plant & machinery/ equipment for manufacture or service holder as below:

Existing Enterprises Investment Limit on Manufacture Sector:

Enterprises of manufacturing or production sector can be invested the amount in plant and machinery field as mentioned by the below limit.

- Micro Enterprises: A micro enterprise can invest capital upto Rs. 25 lakh in plant and machinery (≤ 25 lakh).

- Small Enterprises: A small enterprise can invest capital Rs. 25 lakh to Rs. 5 crore in plant and machinery (> 25 lakh and ≤ 5 crore).

- Medium Enterprises: A medium enterprise can invest capital Rs. 5 crore to Rs. 10 crore in plant and machinery (> 5 crore and ≤ 10 crore).

Existing Enterprises Investment Limit on Service Sector:

Enterprises in the service sector can be invested the amount in equipment field on the basis of the below information.

- Micro Enterprises: A micro enterprise couldn’t exceed Rs. 10 lakh of investment in equipment (≤ 10 lakh).

- Small Enterprises: But in case of small enterprise, you can invest in equipment and furniture purchase more than Rs. 10 lakh but shouldn’t more than Rs. 2 crore (> 10 lakh and ≤ 2 crore).

- Medium Enterprises: In medium enterprises case, a business holder can invest the amount more than Rs. 2 crore but not more than Rs. 5 crore in equipment sector (> 2 crore and ≤ 5 crore).

Here is the limitation chart for enterprises according to Ministry of Micro, Small & Medium Enterprises

|

Enterprises Classification |

Investment Ceiling Limit on Manufacture Sectors |

Investment Ceiling Limit on Service Sectors |

|

For Micro Enterprise |

≤ Rs. 25 lakh |

≤ Rs. 10 lakh |

|

For Small Enterprise |

> Rs. 25 lakh and ≤ Rs. 5 crore |

> Rs.10 lakh and ≤ Rs. 2 crore |

|

For Medium Enterprise |

> Rs. 5 croe and ≤ Rs. 10 crore |

> Rs. 2 crore and ≤ Rs. 5 crore |

Here we want to inform you one thing that recently the government has revised the new definition of MSME. There has been a long-pending demand for revision. The decision has taken at the Union Cabinet Meeting on new classification of MSMEs with regards to their investment and annual turnover.

The current classification is based on the investment in plant & machinery for products based companies and equipment for services based organization.

Government of India (GOI) doesn’t want to make distinction between Manufacturing and Services unit. They are thinking to give the same priority to both of the sectors.

Investment limit is revised to upwards whereas additional criteria of turnover also introduced.

In this proposed amendment, GOI has redefined the MSMEs threshold criteria for enterprises; means the Manufacturing Enterprises having Investment less than Rs. 1 cr. is considered as Micro, less than Rs. 10 cr. as Small, and less than Rs. 20 cr. as Medium Enterprises. Whereas, Service Enterprises having Annual Turnover upto Rs. 5 crore is measured as Micro, Rs. 50 crore as Small and Rs. 250 crore as Medium enterprise.

Revised MSME Classification

|

Composite Criteria: Investment and Annual Turnover |

|||

|

Classification |

Micro |

Small |

Medium |

|

Manufacturing |

Investment < Rs.1 cr. |

Investment < Rs.10 cr. |

Investment < Rs.50 cr. |

|

Services |

Turnover < Rs.5 cr. |

Turnover < Rs.50 cr. |

Turnover < Rs.250 cr. |

The change would be effective when the proposed amendment to Micro, Small and Medium Enterprises Development Act, 2006 come into effect.

Importance of MSME in India

MSMEs have the pivotal role in nation like India for their growth and development, so that’s why state and central governments have conceptualized to provide the maximum benefits to the enterprises those who are falling under the MSME scheme.

MSME enterprises are the backbone of India which can trigger the economic growth of a developing country like India and also developed countries in the world.

So many of the economists in the world termed the MSMEs as “Engine of Growth” which plays a key role for development of any country; if I am not wrong, India is heading towards the engine of growth.

MSME is playing an equitable and prominent role for building the development of country’s growth by creating potential employment opportunities for young Indians at a low capital cost. So we request you to do your enterprise registration and be a part of nation building concept.

Why Entrepreneurs Should Do MSME Registration?

Acquiring MSME registration certificate is not legally mandatory for a business or enterprise, but you have to acquire the advantages of Udyam Scheme through which an organization can grow like a tree.

So we will be advised you always that registering your enterprise under MSME scheme can get a variety of several benefits from the government sectors including lower interest rates, excise exemption scheme in respect to specified commodities, tax subsidies, exemption under Direct Tax Laws, power tariff subsidy, capital investment subsidies, etc.

If you need our assistance, then we will be helping you to get your MSME registration certificate in Bangalore Karnataka or any other cities in India within a stipulated time period.

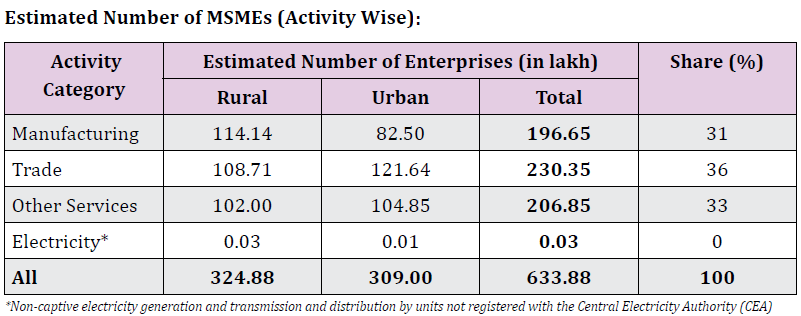

As per MSME Annual Report 2017-18, the below image is representing the estimated size of registered enterprises (activity wise) in India; really they are performing well for the sake of themselves as well as for nation’s growth.

Benefits of MSME Registration in India

Why should an enterprise register under the Udyog Aadhaar and what are the facilities it will get from MSMED?

Therefore, we explained briefly some important advantages on MSMEs below:

To encourage the growth of MSME both State and Central Govt. are immensely targeting their incentives, subsidies, and schemes and support packages to the registered MSMEs through MSMED Act, 2006. After registration, any enterprise can be qualified to gather or avail the benefits offered under the MSMED Act.

So the advantages or benefits will be offered to the MSMEs according to their classifications and competitiveness.

Here look at some key benefits of MSME registration under the Act of government to the enterprises.

1. Easy Availability of Loans from Banks: All banks are ready to lend the business sectors according to their setup and apart from this, MSMEs are recognized by banks, they offer financial support with lower interest rate as compared to typical business rate.

2. Tax Rebates under the MSMED Act, 2006: MSME registered business may enjoy multiple tax exemption scheme and capital gain tax subsidies from the government.

3. Easy Access to Credit: Mudra Yojana Scheme has introduced by PM Modi which provides loans to MSMEs without security. And enterprises can take the advantage from this scheme to raise their business.

4. Get Benefits from State Governments: Those enterprises that have registered under MSMED Act for them most of the states and union territories offers subsidies on power, taxes, entry to state-run industrials, capital investment subsidies and also exempted from sales tax.

5. Get Benefits from Central Governments: Enterprises can get easy sanction of bank loans on priority sector lending, excise exemption scheme, exemption under direct tax law, lower the rates of interest and support such as reservation, etc. Apart from this central government announces various schemes from time to time for MSMEs where they can get benefit from it and creates an environment for opportunities.

6. 50% Discount on IP Protection: Government will financially support to technology startups for International Patent Protection in Electronics and IT (SIP-EIT) by reimbursement up to 50% of total patent cost, with Rs. 15 lakh limit.

7. Credit Guarantee Fund Scheme: This credit will be eligible to micro and small enterprises covering the credit limit per borrower from Rs. 100 lakh to Rs. 200 lakh as in recent update on 20th February, 2018 by Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE).

8. Capital Subsidy for Technological Upgradation: This scheme is operating for modernization of technological upgradation of Small Scale Industries (SSI) through the Credit Linked Capital Subsidy Scheme (CLCSS). An enterprise can get ceiling loans under this scheme from Rs. 40 lakh to Rs. 1 crore and the rate of subsidy from 12% to 15%.

9. Market Development Assistance for Micro, Small & Medium Enterprises: This scheme helps funding for participating international fair, trade delegations, publicity, etc. The Government will repay 75% of air fare in economic class and 50% of space rental charge for general category and 100% of air fare in economic class and space rent for Women/ SC/ ST entrepreneur.

Documents/ Information Required for MSME Registration in Bangalore Karnataka

- PAN and GSTIN of the Company/ Individual

- Aadhaar card of the applicant

- Total capital investment

- Date of Incorporation of Company

- Registered office address of the company

- Bank details like IFSC Code and Account Number

- Nature of business

- Number of employees

How to Get MSME Certificate in Bangalore, India?

We want to clear here one thing that applying for MSME and getting the registration certificate in Bangalore Karnataka or any other cities in India will be the same process for every state; you have to follow the Udyog Aadhaar registration process to get the UAM (Udyog Aadhaar Memorandum) number in India.

You don’t need to be confused, where to apply and how to apply.

Because all the application process for MSME registration in India would be done completely on online through the help of Udyam Registration Portal only i.e. https://udyogaadhaar.gov.in/ which is the official website for MSMEs and startup; is maintained by the government of Ministry of Micro, Small and Medium Enterprises.

You would be happy to know that there are plenty of companies in Bangalore as well as the rest of Karnataka that can help you get an MSME (ministry of micro, small and medium enterprises) certificate and that too within a span of 2 to 5 working days.

Validity of MSME Certificate

This certificate is valid for the lifetime of your organization; both service and manufacturing sector companies can avail the same. You can also Update/Cancel your Udyam Registration over the time. There is no limit on the number of companies that can be registered by a single entity. It also helps that these services are rather economical.

Udyam Registration Process

Ministry of MSME has redesigned and launched Udyam Registration portal for entrepreneurs to make Atmanirbhar Bharat Abhiyaan more supportive, committed, intesified and powerful for national entrepreneurship.

At this time, the existed and new enterprises have to register in Udyam Registration portal (the official website for MSME registration) as a MSME .

Here is the way for new Udyam Registration Process:

- For New Entrepreneurs Who Are Not Registered Yet as a MSME

- For Those Already Having Registration as EM-II or UAM

Look at the 24 key points of MSME registration in Udyam Registration Form that is required to register a new business or enterprise as a MSME:

1. Just visit https://udyamregistration.gov.in/ for new MSME or SSI registration under MSMED Act.

2. Enter Aadhaar Number and Entrepreneur Name as per Aadhaar card and then click on Validate & Generate OTP button, a one time password will be come to your aadhaar registered mobile number. You have to just verify the OTP.

After verifying the OTP, a form will come on same window and you have to fill and select the different fields of that form below the following way

3. In Social Category field, you have to choose one option (General, Scheduled Caste, Scheduled Tribe or Other Backward Class) from the dropdown.

4. In Gender field, the applicant has to select the gender of entrepreneur.

5. In Physically Handicapped field, you have to select the physically handicapped status (Yes or No) of entrepreneur.

6. In Name of Enterprises field, the applicant must have to fill the enterprise name which is known by your customer.

7. In Type of Organization field, the applicant has to choose one of his/her organization name from the radio buttons like Proprietor, Partnership, Company, etc.

8. In PAN Number field, PAN number is required for Co-Operative Society, Private Ltd, Public Ltd or Limited Liability Partnership (LLP). But it is optional for other business type.

9. In Location of Plant Details field, if your organization has multiple plant location, you can add it in one registration by clicking Add Plant button.

10. In Official Address of Enterprise field, the applicant should fill the details appropriate field with complete postal address of the enterprise including State, District, PIN Code, Mobile No and Email.

11. In Date of Commencement field, enter the operation date of your business from which day you’ve started it.

12. In Previous Registration Details (in any) field, if you have already applied Udyog Aadhaar registration for an enterprise and issued a valid EM-I/II through the respective concerned GM (DIC) as per the MSMED Act 2006, such number have to mention in appropriate place.

13. In Bank Details field, you must provide your bank account number that is used for running the enterprise and also mention the IFS Code of the bank’s branch office.

14. In Major Activity field, here you have to choose what your enterprise is doing for, either “Manufacturing” or “Service” under Udyog Aadhaar. If your business involves in both type of activities and major portion of work covers in Manufacturing sector and small portion of work covers in Service sector; then select you major activity type as “Manufacturing” and if major portion of work covers in Services and small portion of activity covers in Manufacturing; then select your major activity as “Services”.

15. In National Industry Classification Code (NIC Code) field, you have to choose multiple National Industrial Classification (NIC) Codes for your all business activities relating to “Manufacturing” or “Service” sector. And here these activities are classified into 3 categories; you should choose it one by one through NIC Code just typing two or more characters of activity in search box.

16. In Person Employed field, here you have to give information on how many employees are working with you and who have been directly paid their salary/ wages by the enterprise.

17. In Investment in Plant & Machinery/ Equipment field, so here you have to enter the total investment (purchase value of items) cost for enterprise.

18. In DIC (District Industry Centre) field, according to the location of enterprise; you have to fill the location of DIC. While filled the DIC location, the column will be active and show options, if is there any DIC is available for that district or not. If there is only one DIC in the district system, it is automatically register your enterprise in the same DIC.

19. In Submit field, the applicant should click on Submit button; where it creates an OTP which will be sent to your Aadhaar linked Mobile Number for registration purpose. You need to enter the OTP on specified field and verify it for application submission purpose.

20. In Final Submit button field, you need to verify the captcha code and then click on Final Submit button. And here your application process for MSME registration is finished now.

And you will get an applied application form of Udyog Aadhaar Memorandum (UAM) bearing with UAN (Udyog Aadhaar Number). Click below on Print button to get it as pdf format for future purpose.

At the same time; just below the Print button, a registration certificate option will be there; by clicking on that, you will get a system generated Udyog Aadhaar Registration Certificate from this.

How to Verify Udyam Registration Online?

You can check the status of your applied enterprise registration in Udyam Registration Official website through the following 2 steps:

It is easy and simple, you can do it for your Udyam No.

- Visit to home page of Udyam Registration site, move your mouse pointer to “Print / Verify” menu and click on "Verify Udyam Registration Number".

- Enter 19 digit Udyam No., make verification with Captcha image and click on “Verify” button. It will show all your details of business for what you’ve registered.

How to Get Printout of Udyam Registration Certificate?

- Visit Udyam Registration site, go to "Print / Verify" menu and click on "Print Udyam Certificate" link.

- Enter your Udyam Registration Number, mobile muber as filled in Udyam Application and choose any option to receive OTP to your Mobile or Email. Then click on "Validate & Generate OPT" button.

- After the above step, enter OTP and click on "Validate OTP & Print" button, you will be auto direct to Print Certificate window. You can take print from here.

How to Edit or Update Udyog Aadhaar?

To make improvement of doing easy of business for industrial and service sector enterprises, the Ministry of MSME has introduced a provision to enable the applicant could edit/ update Udyog Aadhaar Memorandum.

When an enterprise or business wants to update or edit new fresh information to its existing Udyog Aadhaar registration number, then the applicant can move for that with this easy process. See here below:

- You’ve to visit Udyog Aadhaar site. Find “Update Udyog Aadhaar” menu from menu bar and click on it.

- Enter 12 digits UAM Number of concerned business, select OTP option (by default “OTP on Mobile as Filed in Application” is being chosen already), verification code and click on “Validate & Generate OTP” button. Then an OTP will come to your chosen option (means Mobile or Email), verify this and update your enterprise data.

- Edit the information what you want to change details in your business and click on Submit button.

- After editing, you can take a print of edited UAM through “Print” menu.

-----------------------------------------------------

Related Posts:

FSSAI Registration License in Bangalore, India

How to Apply for Import Export Code Registration in Bangalore?

Why and How to Apply for Shop & Establishment Registration in Bangalore?