Our Services

About Business Windo

BusinessWindo.com is a unique platform which provide opportunities to young & aspiring minds. It offers online consultation, to budding entrepreneurs pan India, in overcoming the initial formalities of starting a business. This is an initiative to utilise the bandwidth of legal and financial fraternity in business, by lending support to the start-ups under one roof. This one-of–its-kind platform, comprises of legal and professional experts who helps these business set ups.

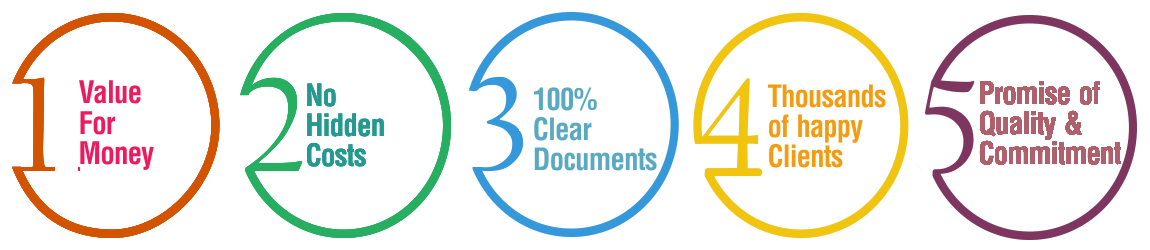

BusinessWindo.com is a unique venture with an initiative to serve start-ups and new business set ups and support them with services such as New company incorporation, Tax registration, Filing of various taxes, Secretarial services, Chartered accountant services, Trademarks, Copy right, Patent and many more at affordable charges with better transparency.

Unlike other service providers, BusinessWindo provides more than 50 services to its users. In addition, all services are relatively affordable compared to the market and still maintaining the high quality standards.

With a team of young, energetic team it focuses on providing hassle free, transparent online services on www.BusinessWindo.com at affordable price.