Private Limited Company Registration

Within 7 Days

- DSC for Directors

- DIN for Directors

- Memorandum Of Association (MOA)

- Articles Of Association (AOA)

- Company Incorporation Certificate

- Company PAN & TAN

Private Limited Company Registration

Private Limited Company

By definition, a Private Limited Company is “privately” owned by at least two owners and directors whose liability is restricted to the number of shares owned by them. The company is considered as a separate unit than that of its owners. It is the most convenient way of establishing new businesses.

Characteristics like being able to raise funds through investors, operate after the owner’s death and lesser tax liabilities make it a preferred choice among business owners to make a foray into the competitive market.

Private Limited Company is a private company held by the individuals or group of persons to run their business smoothly by incorporating the company under the laws of Companies Act, 2013 in India. Most entrepreneurs are opted this entity by thinking about the scope of growth and expansion as compared to LLP and Partnership. It secures all the advantages of partnership as well as limited liability.

A Private Limited Company is a blend of corporate form of business structure and partnership. This entity has a reputation in the corporate world due to their firmness, quality of trustworthy, name and fame by which it can get help from financial institutions, angel investors and venture capitalists, etc.

Private limited company registration

Typically company registration means getting legal identity by acquiring certificate or license from Government department to do a business officially. It is also known as company formation or incorporation.

The Ministry of Corporate Affairs, Companies Act, 2013 Companies Act, 2013 and companies Incorporation Rules, 2014 regulate the registration of private limited companies. The owners can file for registration by themselves online or through registered agents. The owners also need to disclose their business information honestly to avoid legal nuisance in future and create a trustworthy name in the industry.

Advantages Of Private Limited Company

See, these are the major advantages of a private limited company:

Separate Legal Entity

The company will be treated as a separate or distinct legal entity from its members (Directors/ Shareholders/ Promoters) in the eyes of law and it has the ability to enter into the agreements or contracts in subject to certain duties and obligations, to sue or to be sued of its own rights. The company has separate legal personality; this feature isolates the activities of the company from individuals or other company.

Borrowing Capacity

A company can get or borrow the available amount of money/ finance by issuing debentures to public. Anyway the lenders also get pledged on company to determine about the borrowing capacity on the basis of the company’s current status as a security to pay back his money within a specified time period. Apart from this, banks and financial institutions preferred to provide financial assistance as the company separates from its owner.

Limited Liability

Limited Liability means the liability that should not exceed the amount invested in a company. For every company, the liability should be legally limited to their respective current status. The liability is limited to the members of private limited company according to their amount of shares held by them respectively where shareholders/members are legally obligations for the liability of a company only to the extent of their nominal value of shares.

Owning Property

The ownership of any property like land, building, objects, intellectual property and etc. may be legally acquired privately or publicly. Like same, this is a great thing in company law that a private company can acquire the property and assets by its own name. The company has the right to property or right to own property is similar as human right for natural person.

Easy Transferability

Transfer of ownership in private company is not so difficult, because you know that a corporation is a separate legal entity from its owner; if the owners (Director) of a private limited company wants to exit from business can handover his/her stake to the new owner or partner by selling their proposed shares and stocks; is same as in case of Shareholders also.

Easy Debt Access

A company has the ability to access the finance from the outside by considering its strength. It has huge opportunity to access debt from financial institutions, venture capitalists, bankers and etc. by its own advantages. And a Private Limited Company has more debt opportunities to go ahead with board of certain plans rather than Limited Liability Partnership (LLP) or One Person Company (OPC).

Minimum Requirement for Private Limited Company

A private limited company requires minimum two directors, one of which should be an Indian resident and number of members (shareholders) restricted to 200 and minimum paid-up share capital 1 lakh rupees. The directors need to obtain a DSC (Digital Signature Certificate) from any Certifying Authorities (CA). And a DIN (Director Identification Number) can also be obtained from SPICe e-Form through the Ministry of Corporate Affairs during the company registration process. It is also needed that the company uses “Private Limited” along with its name. The applicant has to give only one name which will then be approved based on uniqueness and availability. The company should also have a verifiable registered address.

The following necessary requirements are needed to register a private limited company in India:

- A private limited company requires minimum two directors, one of which should be an Indian resident;

- Minimum 2 numbers of members (shareholders) and restricted to 200;

- Minimum paid-up share capital 1 lakh rupees;

- The directors need to obtain a DSC (Digital Signature Certificate) from any Certifying Authorities (CA).

- DIN (Director Identification Number) for directors can also be obtained from SPICe e-Form through the Ministry of Corporate Affairs during the company registration process.

- The company should also have a verifiable registered address.

- It is also needed that the company uses “Private Limited” along with its name. The applicant has to give only one name which will then be approved based on uniqueness and availability.

The main procedures to get a private limited company registered can be summarised as follows:

- Select a name that doesn’t bear direct resemblances to any other business.

- Choose directors and obtain DIN and DSC permitted by the Ministry of Corporate Affairs.

- Register company office address

- Submit essential documents such as identity proofs, residential proofs, signed registration papers etc.

- Register company office address

- Acquire company incorporation certificate

Keeping all these essentials in mind, a private limited company can be easily set up and can prove to be highly beneficial for business ventures and their success.

Documents Required For Company Registration

BY DIRECTORS & SHAREHOLDERS

- PAN Card

- Voter Id / Aadhaar Card

- Driving License / Passport

- Latest Bank Statement / Mobile Bill

- Passport Size Photograph

FOR OFFICE ADDRESS PROOF

- Rental Agreement (In English)

- No Objection Certificate

- Electricity Bill

- Sale Deed / Property Deed

- Tax Paid Receipt ( In case of own property )

Procedure Required Registering a Private Limited Company in India

The following steps are essential to incorporate a company in India:

Name Approval

( 1 Working Day )

Before registering your company, the founder of the company first choose only one unique and desirable name by using RUN (Reserve Unique Name) service through MCA portal as per 2018 company incorporation rule and get the name approval for this. There is no other option to choose six names as earlier but if it is rejected, you can apply for another name.

Obtaining DSC

( 2 Working Days )

Digital Signature Certificate (DSC) for designated directors must be required for e-filing on MCA portal. DSC is a secured electronic signature, a DSC application needs to be filed along with candidate ID and address proof & it should be duly attested by bank manager or gazetted officer or post master. It requires minimum 2 working days to obtain a DSC.

Obtaining DIN

( 3 Working Days )

DIN or Director Identification Number is a unique 8 digit alphanumeric number assigned to the proposed director of a company for its special identification by the Ministry of Corporate Affairs (MCA). DIN is a must needed primary key proof for a Director. Now DIN can be obtain for Directors on new companies by applying directly through the SPICe e-Form only.

MOA & AOA

( 1 Working Day )

MOA is the charter of the company and defines the objects, scope of its activities and relation to the outside world. MOA is the main document required to incorporate a company in India. AOA is a legal document of a company which defines the rules, regulations and responsibilities of the directors, shareholders or members along with accounts and audit information. Drafting MOA & AOA can be completed in 1 day.

Company Incorporation

( 2 Working Days )

After filing all the forms and submitting documents for your company on MCA portal to the regional concerned ROC office, they will take it for verification. Once it is verified and the processing of Forms is completed and a Corporate Identity Number (CIN) is generated then you will be receiving your Certificate of Incorporation (COI) issued by ROC along with the PAN and TAN number issued by NSDL.

Applying PAN & TAN

( 3 Working Days )

Company PAN and TAN has already applied in SPICe e-Form during the company incorporation process and when you received your company incorporation certificate (CIC) from ROC by Minister of Corporate Affairs; at the same time, you will be intimated your company PAN and TAN number in the certificate. After one week, you will receive your company PAN & TAN card which is dispatched to your registered office address.

What You Will Get After the Registration ?

- DSC for 2 Directors

- DIN for 2 Directors

- Memorandum Of Association (MOA)

- Articles Of Association (AOA)

- Company Incorporation Certificate

- Company PAN & TAN

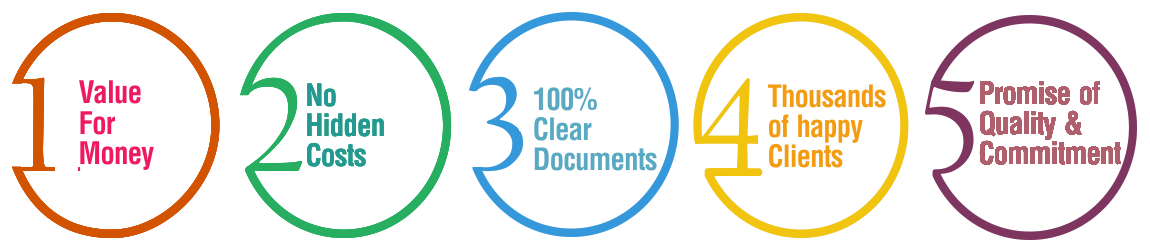

Top 5 reasons why entrepreneurs opt for a private limited company

Registering for a private limited company is definitely a favoured method of starting a new business. Below are top five reasons why entrepreneurs opt for a private limited company:

1. Different legal status:

A private limited company has a legal existence distinct from its owners, that is, its entity is separate from the one who owns it. It is because of this that these companies can continue to operate even after the owner’s death. This also gives the company right to take legal action against another business, person or legal entity if need be.

2. Ownership rights:

The Company’s assets are different from its owners’ assets. The company can hold assets and properties in its name and no single owner can claim its rights till the company is a functional one.

3. Easy funding:

One of the main reasons why entrepreneurs opt for a private limited company is the reliability and opportunities it gives to business owners. Since the company is registered with the Government with necessary business details such as investors’ details, status etc., raising funds become easier. This visibility gives future investors a confidence in the business and allows the owners to pursue attractive opportunities available in the industry.

4. Easy exit:

The owners have liability towards the company only to the amount of shares possessed by them. Hence, while exiting the business, the owners can simply sell or transfer their shares to another partner or entity without any legal binding.

5. Lesser tax liabilities:

A private limited company enjoys less tax liabilities than its publicly listed counterparts. Besides compensation, it can also share dividends or profits with owners and employees, which has lesser tax implications than salaries. The company can also contribute towards its employees benefits such as healthcare and pension that allow for more tax deductions than usual.

Benefit of Private Limited Company

A main advantage of private limited company is its shareholding pattern being fairly simple in that its shares are not available in the stock exchange to buy or sell.

The company’s directors, members of the management and the investors are its shareholders. This restricts the control to the company’s owners and results in less interference in operations and policies.

Also, private limited companies don’t have to bear the cost of exhaustive legal formalities that public listed companies have to go through. Unlike a publicly listed company, a benefit of a private limited company is that it doesn’t require large sums of share capital. The company can hold as much or as less share capital as feasible for it.

Factors to be Considered While Registering a Private Limited Company

While registering a private limited company in Bangalore, Karnataka or any other cities in India; several costs related to start and operate needs to be kept in mind.

A private limited company can either be setup online or offline. In case it is done offline, a legal advisor needs to be hired whose fees will depend on his/her expertise. Besides that, a nominal fee depending on the authorised capital will be charged as a start-up fee.

The same process can also be done online, where the fees might be lower and the procedure has to be carried out by the owners or by the agencies like us (BusinessWindo) with the proper guidance of our highly well experienced lawyers and legal professionals. These are the main points you must consider to register a private limited company.

Besides the start-up fee and process, the owners have to be vigilant about other compulsory costs and processes which usually include name reservation fee, compulsory and sundry compliance costs. But company registration fee is waived by MCA upto authorized capital Rs. 10 lakh.

Regular accounting and a yearly auditing process should also be accounted for while setting up the company. A main factor to be considered for private limited company is that the owners must maintain up-to-date accounts of their business and consult expert accountants and auditors to do the job.

Post Incorporation Compliances

Once the company is registered, based on the nature of business the following various registrations have to obtain:

- GST Registration

- PF Registration

- ESI Registration

- Professional Tax

- Shop & Establishment Registration

- FSSAI Registration

- Trade License

- ISO Certification

- Drug License and more

Compare Company Registration Options

Why Choose BusinessWindo.Com ?