Company Registration – How to Register a Company in Bangalore India?

Posted on: 2018-10-20 04:22:26

Nowadays registering a company in India is easy and simple through MCA (Ministry of Corporate Affairs), it is making simplified procedure for entrepreneurs to register their business in a quick process of short time.

But before we are moving to the topic, we want to share a little information about India’s business environment ambiance.

According to the survey of World Bank’s Doing Business Report 2018; India ranked 100th place out of the 190 countries and one of the top five reformers on holding conducive business environment as stated by the report.

You will find another scenario of India about easy of doing business. India advanced 23 points up to 77th place rank in World Bank's Doing Business index for 2019, from 100th in 2018 and 130th in 2017. India is becoming the top ranked country in South Asia for first time and 3rd among the BRICS.

India has achieved 63rd position out of 190 countries in the World Bank’s Ease of Doing Business 2020 report by jumping 14 places from last year status and preparing a blueprint for further improvement on India’s ranking in the World Bank’s ease of doing business index.

India is focusing on 6 parameters to get better score on doing business such as:

- Starting a business

- Registering property

- Paying taxes

- Trading across borders

- Enforcing contracts and

- Resolving insolvency

India is creating better investment climate for budding off creative and innovation business ideas.

Innovation and creative enterprises are the foundation of making India a developing nation.

Government is already planned to wheel a new industrial policy which would lead the India to make the business more competitive and create more jobs, according to the Department of Industrial Policy and Promotion (DIPP). And it is already presented in Cabinet for approval.

The proposed policy will be focused on three pillars such as Competitiveness, Sustainability and Inclusion.

- Emphasis on reducing the cost of business if the industry has to become competitive.

- The policy proposes on the establishment of Centre and States; which is similar to GST Council like body that will enable the quick decisions on key changes such as the renovate of labour laws, taxation provisions and land leasing.

- The policy proposes a direct benefit transfer (DBT Mechanism) for power subsidy to reduce the industrial electricity tariffs.

Government wants to make India as the world’s next manufacturing hub and aimed to creating millions of jobs and boost growth.

On this part, the government has also launched various enabled programs such as Startup India, Make In India, Digital India, and Skill India over years for fostering the growth and development of the entrepreneurial spirit in the country and world. Startup India scheme is one of such flagship for nurturing the innovation and startups in the country. Apart from Startup India, the recent Union Budget has also announced a slew of measures to strengthen the entrepreneurship climate for startups in India.

This is the nice time to start your business and devote your time to build it and create a good customer relationship.

Before jumping towards to register a Pvt Ltd or OPC or LLP or Partnership or Proprietorship or Public company or etc; an entrepreneur might be clear about the things such as companies requirements, why a company needs to be registered, details particulars required from promoter/ director or subscriber, at where you want to start your business, documents required for company registration, company incorporation process, minimum requirements to form a company and points to remember while forming a company.

In this article, we will discuss the following points on company formation procedure:

- What is a Company?

- What is Company Registration?

- Types of Companies & Its Categories are Available to Register in India

- Why an Entrepreneur must Register his/her Company or Existing Business?

- Factors to Remember during the Formation of a Company

- Minimal Requirement to Form a Company

- Documents Required from Directors/ Promoters and Subscribers/ Shareholders

- Procedure to Incorporate a Company in Bangalore, India [In this section, we have covered the exact process of incorporation in a expressive way of step-by-step guide for clearing about the most important things on it]

- Documents need to Preserved for Company

- How Long Time does it Take to Register a Company?

- How Much does it Cost to Register a Company?

- Know the Status of Company by Checking

Let’s move to the point by starting from a company.

What is a Company?

By Definition: A Company is a registered organizational institution or corporation which can be established by one person or group of persons to perform their business for profit or not-for-profit under the Companies Act, 2013. It constitutes the aim of common goal called business by its unique name, members/shareholders and directors. After company incorporation/ registration under the Company Act, 2013; company becomes a legal entity and it gets its rights and responsibilities defined by the law.

Simply put, a Company is a corporate body and legal entity engages in business by made up of on association of both natural and legal persons for carrying on commercial or industrial enterprises and is incorporated under the existing Company Law as stated by the Companies Act, 2013 of the country.

What is Company Registration?

Company registration is the legal process where a company or an organization can register/incorporate its business into MCA (Ministry of Corporate Affairs) and get listed as a legal organized business structure for its company. After getting registration, the entity would get the certain benefits which must be needed for it and through this it can acquire a huge trust from customers and build a good relationship.

Before registering a company you must check your desirable company name online in MCA portal; and see is it available to you or not!

It means a company or a business register its name, office address, directors name and subscribers in MCA through the regional Registrar of Companies (ROC) offices to get certain legal protections and facilities to start, run, manage and grow the business.

Because we are in a system and this system creates opportunities to enter into a big corporate world. So we need to take the advantages and move ahead of the curve.

The Kinds of Companies are Available to Register in India

There are various types of companies you can find here to register in India. Here you can take a look at the following types of business entities are available to form.

- Limited Liability Partnership (LLP) Company

- One Person Company (OPC)

- Private Limited Company

- Public Limited Company

- NBFC Company

- Foreign Subsidiary Company

- Section-8 Company

- Producer Company

- Partnership Company

- Sole Proprietorship Company

Categories of Companies

As per Indian Companies Act, 2013 Law, a company can be formed under Section 3(1) may either be limited by shares or limited by guarantee or it may be unlimited company. So types of companies are classified into 3 categories as in follows:

- Company Limited by Shares

- Company Limited by Guarantee

- Company with Unlimited Liability

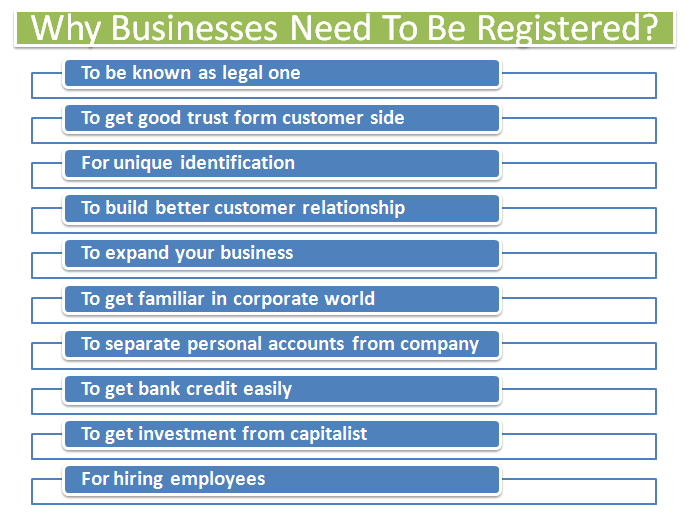

Why You Must Register Your Company or Existing Business?

Creating business for people is not about to bothering but helping to them. Aspiring entrepreneurs always desire to make it big and do the valuable things to achieve the goals in their business life.

To succeed in business life, it does not require any management degree, it requires how valued your products or services as per price and how you are dealing with customers. Giving first priority to customer is the main funda of business.

There you can find many stirring real life stories of successful people who have succeeded as entrepreneurs but they did not possess any management degree. Also you can find various businessmen’s proof that a business doesn’t necessarily required any management school certificate but an idea, innovation, thought, an ability to dream and a lot of conviction to make a mark.

So an entrepreneur (you) should have to be creative, imaginative, skilled, dedicated and responsible. Being an entrepreneur means you always have to wear multiple hats and roles for your business.

You are thinking to enter into entrepreneurship career to reach in your goals. As you are going to setup a new company or running an established business, then you ought to have a registration to place your company on top rank among the corporation field. It is very important that you can get your proper return of each and every pound of money that you are going to invest or invested in your business.

People register their business by validating their business ideas. And registering a business is important to get the advantages of corporation name and when you register it, it is even more important. So go ahead and register your business even before you find your first customer and make your first money for company.

But how can you achieve it and reach in your goals. There are some reasons, so you should have to register your business to get the benefits. Here are some essential points you need to keep in mind on behalf of your business preferential:

- To Expand Your Business

- For Unique Identification

- To Familiar in Corporate World

- To Build Better Customer Relation

- Separating Professional Account from Private

- Easier to Get Bank Credit

- Get Investment from investors

- Hiring Employees

For this reasons, it is necessary to incorporate your company or existing business to avoid some legal actions of corporate affairs. Absolutely out of many expenses you have to spend some thousands of money for your company registration during the starting of company or business. To get benefits and protection from this we can’t avoid it, we can say there are several reasons for company security like protection of assets, securing your products, satisfying monetary requirement, big name business, etc.

That’s why India has put his head to business power, now it is going to be a hub of business sector by creating development in innovative thoughts to stand by the worldwide. India is a land of opportunity where you can spread the seeds of business thoughts and implement it perfectly to get the successful results. Know what the ingrdients are required to start a startup in Bangalore.

So because of this, American and foreign renowned business magnates are talking about the invest hub of India.

Factors Need to be Remembered While Forming a Company in Bangalore

When you are going to form a company in Bangalore, Karnataka or any other cities in India; you should have to think it globally but act as local and for this, certain factors need to be considered for preparing a business plan to setup your company swiftly.

So these are the top 10 factors where you can get the clues to invent your business journey. Here you can look over the different phases of the business creation process during formation of a company.

- Validate Your Business Idea

- Arrange Funds from Venture Capital

- Make Competitive Analysis

- Design a Strategic Business Plan

- Select a Suitble Company Name

- Get Registered or Incorporate the Company

- Get Certificate of Incorporation (COI) for Your Company

- Subscribe Share Capital by Investors/ Share Capital Subscription by Shareholders

- Start Your Business Journey

- Make Promotion for the Company

According to the Section 3(1) of the Companies Act 2013, that a company may be formed by you and your partners for any lawful purpose act. Here you can look over the minimum number of persons or members required to form a various types company.

Public Limited Company: It required minimum seven or more persons/members to form a public company. In this company, it must have at least 7 directors and minimum paid up share capital is INR 5,00,000.

Private Limited Company: It required minimum two or more persons/members to form a private company. Means, it must have at least 2 directors to incorporate a Pvt Ltd Company and minimum paid up share capital of INR 1,00,000. Watch this video to know more about private limited company.

One Person Company: Only a natural person who is a resident of India, stayed in India at least 180 days can form OPC. It is also called One Person Private Company which needs only one member/person to operate the business. Means it must be only a single director. The other person can be nominee for this entity.

Limited Liability Partnership: LLP provides the benefits of partnership and flexibility of limited liability. It must have required at least two members to incorporate a LLP company. Get more details on limited liability partnership from this video.

Partnership: A Partnership business consists of two or more persons. There is no minimum capital required to form a partnership startup firm.

Sole Proprietorship: It requires only one person or member to form it. The person of the firm is treated as owner or proprietor and has full authority to control over the business. Know more details about proprietorship firm.

Documents Required From Directors/ Promoters and Subscribers/ Shareholders/ Members to Register a Company

Proof of Identity for Indian Nationals:

- PAN Card is mandatory and any one of the following:

- Aadhaar Card/ Voter Identity Card/ Passport/ Driving License

- Passport Size Photographs

For Foreign Nationals and Non Resident Indians:

- PAN Card of NRI

- Passport of NRI

- Proof of nationality in case the director/ subscriber is a foreign national

- VISA immigration copy along with stamp of arrival

Proof of Residential Address:

- Bank Statement, Electricity Bill, Telephone/ Mobile Bill (it shall not be more than two months old).

As per the Rule 16 of Companies (Incorporation) Rules 2014, these particulars of every director/ subscriber need to be filed with the Registrar at the time of incorporation such as name including surname or family name, recent photograph, father’s/mother’s name, nationality, date of birth, place of birth, educational qualification, occupation, income tax permanent account number, permanent address, present residential address, present office/business address, Email ID, Phone number.

Office/ Business Address Proof is Required to File with the Registrar at the Time of Incorporation

- Rental/ Lease Agreement of same address from landlord of premises

- NOC (No Objection Certificate) from the owner of the address for carrying the business as registered office.

- Electricity Bill/ Telephone Bill not older than two months

- Scanned Copy of Sale Deed/ Property Deed

- Tax Paid Receipt (in case of own property)

Procedure to Register or Incorporate a Company in Bangalore

Registering a startup company or a new business has become pretty easy now in Bangalore, India. This formation of company is a process which results in incorporation of a company into the corporate world. And this is the way where you can acquire the registration certificate for your company.

Before registering your company you should understand and appreciate the benefits of getting your business registered. All company incorporation can takes place online through the Ministry of Corporate Affairs (MCA) with the help of your Regional ROC under the administration of Companies Act 1956, 2013 and 2014 with their rules and regulations of Government of India.

This registration process can be done only in government department portal i.e. www.mca.gov.in and nowadays everything regarding to company registration you can do through online. You can go through the official procedures to register a company or startup just in 1 day with MCA now.

The best part of all is that you (applicant) don’t have to visit to corporate office; you can apply for company registration just sitting in front of a computer at your home with a good internet connection and some necessary equipment accessories. And you should also have some essential soft copies of legal documents at the time of application process.

But you must need a CS (Company Secretary)/ CA (Chartered Accountant) / CWA (Cost and Works Accountant) or CMA (Cost and Management Accountant) membership number, seal and signature for your company application process, if you can do it, that would be better or you can hire a company registration agency they can assist you to complete your all company work related to business, accounting, legal matters and more .

Otherwise we will help you to get registered your company and provide the certificate/ license to your incorporated company as well as your new business easily.

These are the 7 major steps to incorporate a company in India. So we have taken this accordingly.

Let’s start the company registration process by following steps:

- Obtain Company Name Approval from MCA

- Obtain DSC (Digital Signature Certificate) for the Proposed Directors

- Obtain DIN (Director Identification Number) for the Proposed Directors

- Draft Memorandum of Association and Article of Association [MOA & AOA]

- Filing of Documents with Registrar of Companies

- Issue of Company Incorporation Certificate

- Allotment of CIN Number to Company

Here, we discuss the 7 steps below which is must required to register a company. Please have a look over this and get the proper idea and understanding the process about company registration journey.

Step-1: Obtain a Unique Company Name Approval by Making Application to MCA:

What is a company name: Company name is a typical name of a business or organization that reflects the overview of the company. Choosing a unique company name is a major factor for your business because it depends on you which type of products and services you are developing and selling in market. Name should be informative and mind catching when a costumer heard or saw can know immediately by the name that what your business is based on.

Company name serves as trade name of a company or business. This is a legal and business identity of a company. A name of company reflects its brand image through this a company can promote their brand by creating good customer relationship throughout the products/services.

Apart from this, the selection of company name has constituted in three parts i.e. First Name, Middle Name and Last Name. Here you can follow the company name selection procedure

First Name of Company:

For selecting the very first name of company like Private Limited Company, One Person Company, Limited Company and LLP Company is one of the most regulated and complex exercise. It should clearly state the nature of the business of the entity.

The First name describes or indentifies the main activity of the business or company. The company name shouldn’t be identical to the name of an existing company which has already registered under Companies Act, 2013 or any previous company law.

Middle Name of Company:

According to proviso the Rule 8(2)(b)(ii) of the Companies Incorporation Rules, 2014, every company's middle name need not to be necessarily suggestive for the objects of the company; but in case, if there is some indication points out about the objects in the same name, then it shall be kept in conformity with that objects as mentioned in the memorandum.

The Name shall not be allowed if, it is not in congruence with the primary/main objects of the company as it is mentioned in the memorandum of association (MOA) at the time of their business journey.

Last Name:

Last name means last words of company name like surname. According to Section 4(1)(a), the memorandum of company shall state the name of the company with the last word as “Limited” or “Ltd” in the case of a Public Limited Company

In the case of a Private Limited Company the last words used as “Private Limited” or Pvt. Ltd.

In the case of One Person Company the last word used as “OPC Company”

In the case of Limited Liability Partnership Company the last word used as “LLP” or LLP Company

A Not for Profit or Non-Profit company incorporated as per Section 8, but they can’t use “Limited” or “Private Limited” as last word.

The Central Government amended the Companies (Incorporation) Amendment Rules, 2018 which came into force from 26th day of January, 2018 to make simple, faster and easy process for company.

Before you are applying for name reservation, first you/ applicant have to create a user account in MCA portal by generating through your suitable credentials and that User Login ID, which will help you further for submitting and uploading the SPICe, INC-12 and INC-24 Forms at the time of incorporation.

For reserving the name of a company, the applicant has to apply to MCA through RUN service, but previously it was applying through INC-1 e-Form. But, now RUN (Reserve Unique Name) service replaced the INC-1 eForm to reserve a name without requiring DSC and DIN of proposed directors which leads a faster and simplified procedure to get approval quickly.

As per Section 4(4) of the Companies Act, 2013; a person may make an application of the proposed company or existing company proposes to change its name in such a form and manner accompanied by such fees as it may be prescribed to the Registrar for reservation of name.

For Company Name Search, you may check the availability of name here:

http://www.mca.gov.in/mcafoportal/showCheckCompanyName.do

Check the Trademark Search to ensure that the proposed company name should not be violating the provisions according to the Section 4(2) of Companies Act, 2013. If it falls means there is a possibility of rejection.

For Trademark Search availability check here:

https://ipindiaonline.gov.in/tmrpublicsearch/frmmain.aspx

As per Rule 9 of Companies (incorporation) Rules 2014, an application for the reservation of a name shall be made through the RUN Web Service which available at MCA portal by using the RUN (Reserve Unique Name) along with the fee as provided in Companies Rule, 2014 with regarded to Registration Offices and their Fees.

In RUN service, an applicant can apply for two proposed name by choosing its entity type and entering the objectives and any other relevant information in Comments section in support of the purposed name.

The requested name for approval may either be approved or rejected; it depends upon the rules and regulations of company law. It should follow the Section 4(2), 4(3) to avoid the rejection.

The applied name will be checked and processed by Central Registration Center (CRC) and the approval or rejection shall be informed you by e-mail subsequently.

Note to User: As we mentioned above, during the application of desired name, you've to pay Rs. 1000 for name reservation and approval in MCA. The name you've applied for reservation will either be approved or rejected. If it is got rejected, you can apply it through free resubmission once again. Means free resubmission is allowed for one time by editing your form with unique names. But after this, you've to pay charge for re-application of your name in RUN service.

Step-2: Obtain Digital Signature Certificate (DSC) for the Proposed Director:

This is the second step to incorporate a company is to getting the Digital Signature Certificate (DSC). DSC is an electronic document is required to sign digitally on all documents which are submitted online. And it ensures the authenticity of Information Technology Act, 2000 for the submitted documents. It is a legal support to the documents same like as presence of physical signature.

Every individual who proposed to be appointed as a director of the company shall have to obtain a DSC.

DSC binds together a public key with an identity and it can be use to verify a public key belongs to a particular person or entity. This certificate serves as proof of identity of an individual person for a certain purpose.

We can take an example like a driver’s license (DL) which identifies someone who can legally authorized to drive a specific form of vehicles in a particular country or state. In case of physical document we sign it manually similarly digital signature is used to sign on documents electronically.

You can obtain your Digital Signature Certificate by approaching any one of the Certifying Authorities (CAs), registered with Controller of Certifying Authorities (CCA) from the Government department. And the listed agencies are such as: NIC, IDRBT, SAFECRYPT, (n)Code Solutions, eMudhra etc., which are solely available in MCA portal, granted to issue a DSC under section 24 of Indian IT Act, 2000. One can get his/her Class 2 or Class 3 certificates from any of the certifying authorities.

Here you take a look at some website addresses of registered CA agencies:

- www.safescrypt.com

- www.nic.in

- www.idrbtca.org.in

- http://www.tcs-ca.tcs.com/

- www.ncodesolutions.com

- www.e-Mudhra.com

If you are unable to get your Digital Signature Certificate or need any assistance, then contact us we will help you to obtain your Class 2 or Class 3 DSC in Bangalore within limited time frame.

Step-3: Obtain Director’s Identification Number (DIN) for the Proposed Director:

DIN (Director Identification Number) is a unique and legal identification number given to an existing individual or a future proposed director of any incorporating company.

DIN was introduced in India as binding the Section 266A to 266G of Companies (Amendment) Act, 2006.

As per the Amendment Act 2006, acquiring a DIN is mandatory for every director/ designated partner to incorporate their new company. This is the most pre-requisite identification of directors. So every directors of the proposed company shall have to obtain DIN from MCA by attaching the required documents.

Any person intend to obtain DIN shall apply e-Form DIR-3 on Ministry of Corporate Affairs website. There is 1 to 7 steps procedure to apply DIN, you can follow through that or if you have any query relating to DIN can ask freely.

If you are incorporating the company through SPICe (SIMPLIFIED PROFORMA FOR INCORPORATING COMPANY ELECTRONICALLY) e-Form, no need to apply DIN in DIR-3 Form. DIN for directors on new companies can apply through SPICe only.

MCA made easy, simplified procedure and faster process to register your company across SPICe e-Form where you can reserve company name with the help of RUN (RESERVE UNIQUE NAME) Web service, apply DIN, incorporate the company and apply PAN & TAN of company only in a single Form.

This is the best way to complete the major attributes of company registration process within a minimal time.

Step-4: Preparation of Memorandum and Article of Association [MOA & AOA]:

Memorandum and Articles of Association: The two documents i.e. MOA and AOA are formed the integral part for the formation of a limited liability company.

The MOA and AOA are the constitution of company. Both are special document which defines the nature of business, objectives, power, work area, rules & regulations within which the company can operate.

As per Section 4(1), the memorandum of a company states that –

- The company with last word “Limited” is known as public limited company, or the last word “Private Limited” is known as private limited

- The State in which the registered office of the company shall be situated;

- The proposed company is to be incorporated for what objects and any necessary matter might be considered when it is mentioned in advancement.

- The company should mention the liability of members whether it is limited or unlimited and also it states that –

- In case of company who is limited by shares means the liability of its members is limited to their outstanding (debt), if any shares held by them;

- In case of company limited by guarantee means it does not have share capital or shareholders instead the members are act as the guarantors, the liability of the members is limited; the nominal amount up to which every members of the company undertakes to contribute – (a) towards the assets of the company in the events of its winding up; (b) the expenses and charges cost to winding up shall be adjusted among the guarantors according to rights.

- In case of company having a share capital –

- The amount of share capital should be mentioned in memorandum during the company registration and divides the shares into fixed amount among the subscribers and they have to agree with the subscription of MOA to carry out the number of shares (at least one share) by each subscriber;

- The number of the shares of each subscriber to the memorandum indicates their stake in the company.

- In case of one person company; if the subscriber has got death or any incapacity is happened to original member, the nominee becomes the member of the company;

As per Section 5(1), the articles of a company state that it should contain the regulations for management of the company.

After receiving the name approval letter from MCA, the MOA and AOA are required to be drafted. It is the most needed components of a company as similar to constitution and rules & regulation. The MOA states the main and other objects of proposed company. It limits the scope of the activities and power of the company. The AOA contains the rules and procedures for the proposed company as well as duties and responsibilities of its members are defined and recorded clearly.

A stamp duty is need to be paid during the application of MOA and AOA and this stamp duty determines the authorized share capital of the company.

Memorandum of Association [MOA]:

The Memorandum of Association (MOA) is a legal document prepared for setting up the company and its operations. MOA is the charter of the company it defines the scope of the company’s activities and its relations with the outside world. It is a document which carries all things where the company can operate itself.

In simple word we can say, Memorandum of Association is a document that contains the entire fundamental information for company incorporation or formation.

The memorandum of association gives the name of company, name of its members and shareholders as well as where the company is situated with the registered office. It also states the objective of company

Articles of Association [AOA]:

Articles of Association (AOA) are a document that specifies the rules and regulations designed for company operation, management and internal affairs.

Usually Articles of Association is a document contains all the rules and regulations that govern the company. The articles of a company play a very important role in the affairs of a company and conduct its business as well as relations between the members and the company.

Besides this, it is important that, AOA (Articles of Association) is the legal record which holds all the duties, responsibilities, rights of the company and distributes their powers to the members, shareholders and directors/partners of the company. AOA also incorporate the details facts of the company about their accounts and audit.

Step-5: Filing of E-Forms for Company Incorporation:

Filing of Forms towards Registrar of Companies (ROC) is a process to incorporate a company; it plays the vital role for company incorporation where all the essential documents you acquired for company are to be uploaded and submitted in this section.

And here the application for registration of a company shall be filed with the Regional Registrar jurisdiction office in Form No. INC-32 (SPICe) along with the prescribed fee where the registered office of the company is wished to be situated.

Section 7(1) states that the proposed company should be filed with the specific Regional Registrar where the company’s registered office address is going to be situated; for this, the following documents and information is required for registration, namely:

(a) Application for Incorporation of Company

Rule 12 of Companies (Incorporation) Rules 2014 states that an application for incorporation of a company shall be filed with ROC in Form INC-7 (INC-2 in case of one person company)

(b) Memorandum and Articles of Associations of the Company are Duly Signed

As per Section 7(1)(a), the filing of the memorandum and articles of the company duly filled by all the subscribers to the memorandum in such a manner that which is based on the Rule 13 of Companies (Incorporation) Rules 2014

(c) Declaration from the Professional

According to Section 7(1)(b), an Advocate, a Chartered Accountant (CA), a Cost Accountant (CMA) or a Company Secretary (CS) in practice has to file a declaration statements in the prescribed Form for engaged in the formation of the company.

Rule 14 of Companies (Incorporation) Rules 2014 states that for the purpose of clause (b) of Sub-section (1) of Section 7, the declaration by an Advocate or a Chartered Accountant or a Cost Accountant or a Company Secretary in practice shall have to file in Form INC-8.

(d) Affidavit from the Subscribers to the Memorandum

As per the Section 7 (1)(c), each and every subscribers has required to file the affidavit to the memorandum and also from the first directors in the certain prescribed From

Rule 15 of Companies (Incorporation) Rules states that for the purpose of clause (c) of Sub-section (1) of Section 7, the affidavit shall have to submit by each of the subscribers to the memorandum and each of first directors named in the articles in Form INC-9.

(e) Furnishing Verification of Registered Office

Under Section 12, the company shall be capable of receiving and acknowledge all the communications through registered office address from the 15th day of its incorporation and all times thereafter. The company can furnish (produce) to the registrar verification of registered office within 30 days of incorporation.

As per Rule 25(1) of Companies (Incorporation) Rules 2014, the verification of registered office shall be filed in Form INC- 22.

(f) Particulars of Subscribers

As per Section 7(1)(e), it requires the filing of details of the subscriber’s name, together with the surname or name related to family, present residential address, nationality and such other particulars of every subscriber to the memorandum along with the identity and address proof and etc. you can follow this which we have mentioned above in “Document required from Subscriber” para.

In Rule 16 of Companies (Incorporation) Rules 2014, it is stated that the particulars of every subscriber need to be filed in Form INC-7 with the Registrar at the time of company incorporation.

(g) Particulars of First Directors along with their Consent to act as Directors

Section 7(1)(f) requires the filing of the particulars of the first directors of the company, their names, including surnames or family names, the Director Identification Number (DIN), residential address, nationality and such other particulars including identity proof as may be prescribed in the form.

Section 7(1)(g) states that the particulars of the interest of the persons mentioned in the articles as first director of the company is linked with other firms or body corporate along with their consent.

In Rule 17 of Companies (Incorporation) Rules 2014, it is cited that the details of the first director and his/ her interest should have to be filed with the Form-12 along with his/her consent to act as the director of the company.

Step-6: Issue of Company Incorporation Certificate by Registrar:

After filing of e-forms, if all the documents are looks fine and ok, then the registrar is being satisfied with your submitted documents under the Section-7(2) and then ROC will issue your company Certificate of Incorporation in e-form INC-11. Now your company is incorporated under the Companies Act, 2013.

This Certificate of Incorporation (COI) is given by the Registrar will be the strong conclusive evidence to your company and that all the compliance requirements of the Act have been complied through this.

Step-7: Allotment of Corporate Identification Number (CIN):

During the incorporation of company with the concerned regional ROC, under the Section 7(3) of Sub-Section (2), the Registrar would allocate a distinct alphanumeric Corporate Identification Number (CIN) to the registered company which shall be mentioned on the Certificate of Incorporation (COI) along with its approved name, date, categories of company and company PAN number.

Documents of Incorporation to Preserve:

As per the Section 7(4), the company has to preserve all its original registered office copies of documents and information till its dissolution.

This is the way to understand and learn the key points about company incorporation. And we believe that you know the process and it is not a small thing; it requires proper documentations and application. But here, we made a brief clarification of that process which contains the summarized facts which help you to understand and deploy it to register a company.

What are the registrations required after company incorporation?

The following registrations are required for post incorporation of company:

- GST Registration

- Shop and Establishment Registration

- Professional Tax Registration

- EPF Registration

- ESI Registration

- Udyam/MSME Registration

What are the compliances required for companies?

The following annual and tax compliance is required for companies are:

- ROC filing

- Annual return

- ITR filing

- GST annual filing

- PT annual filing and etc.

How much does it cost to register a company?

To register a company in India; some specified fees is there for definitive business structure under the Govt. of India system and you’ve to pay for that. Apart from the government fees, the consultants charge their professional fees to get done this work and it differs from one consultancy to other. And this action is performed by the CAs, CSs, CMAs, Lawyers, Attorneys, Legal Advisors, Consultancies, and Agencies.

But I can say the standard registration fee to setup a company in India starts form Rs. 8,000/- and it varies from agency to agency in different cities as per the requirements.

How long time does it take to register a company?

As said by MCA department, you can register your company in 1 day through help of simple procedure of SPICe Form. But thing is that before registering the company, all the requirements details need to be gathered first then apply for company registration so that one can finish it in a minimal time. It also depends on the professional’s experience, skill and manpower, otherwise it will take more time to complete the work.

We can say it is not easy to register on same day; because you know about name approval, business nature & objectives, preparing MOA & AOA, preparation of particulars into exact format, stamp duty, filing certain Forms and uploading documents are there. However, it can be possible to finish in 1 day? So we take minimum 7 days of working time to get registered a company in Bangalore India properly.

How to check the company is registered or not?

A question may arises to anyone’s mind! Yes I registered the company and got certificate; but the company is genuine or not. So how you will know the company is real/ true? If it is registered in MCA by Government of India law make sure that it’s a real company.

To verify whether the company is registered with MCA (Ministry of Corporate Affairs) in India, you need to visit the MCA website and validate your company without paying any charges.

Here are the simple steps to check the existence of company:

- Visit this link which confirm you registered company name

- Enter company name by typing with clicking “Search” icon

- Click on company name. It automatically takes to company CIN field

- Enter the verfication code and click on “Submit” button. Then it’ll show you all the details about the company. You can know details about the from this section.

-------------------------------------------------------

Related Articles for You:

How to Start a Startup in Bangalore?

Guideline to Choose a Company Name

Steps Involved in Incorporation of a Company

New Company Registration Procedure from Jan, 2018

Difference between Limited by Shares and Limited by Guarantee