Partnership Firm Registration

Within 7 Days

- Partnership Deed Drafting

- Partnership Deed Attestation

- Partnership TAN

- Partnership PAN

Partnership Firm Registration

Partnership Firm

A partnership firm is usually formed by two or persons to carry on a business legally. The “partners,” as the business members are called, share the profits or losses of the business. The business can be conducted by all partners or by just one of them on behalf of all the rest. The partners of the business get into the business by forming the Partnership Deed, a legal document laying down the guidelines for conducting the business and other details pertaining to the business and its formation. It also mentions capital contribution by each partner and the proportion in which they share the revenue or loss from the company. The partners are bound by the Deed and non-compliance to it is considered going against the interest of the business and other partners. All partnership firms fall under the governance of the Indian Partnership Act, 1932, section 4.

The minimum number of people required to form a partnership is two, the maximum being twenty for non-banking ventures and ten for banking institutions. A partnership firm relies on the trust and compatibility that exists among the partners to a large extent; hence, it is absolutely necessary that the partners are genuine with each other before venturing into the business. Partners here have unlimited liability. Unlike in limited liability ventures where partners are not responsible for each other’s conduct or misdemeanors, in a partnership firm the management is one and each partner is responsible for himself and others in the firm. In case there is a need to transfer shares from one partner to the other, all the other existing partners need to give their consent for the same, before the transfer is carried out. The partners also have a principal-agent relation. When one is conducting an important business activity, he/she becomes the agent and the others principal. Similarly, when any other partner acts on behalf of the other, that individual becomes the agent and the others become principals.

A partnership venture needs to be carried out with caution as all partners have equal rights over the business. It is of utmost importance that the partners avoid being at odds with each other in the interest of the business. Unlike in other forms of companies such as a private limited company or limited liability partnership, a partnership firm cannot function after the death of its partners and needs to be dissolved. The partners in the firm need to know how to carry out business with limited capital, as the number of contributors can only be ten or twenty. Hence, efficient management of funds is also very important to avoid bad credit and continue smooth operations.

Types of Partnership Firm in India

In India, you can find there are 3 types of partnership as follows

- Unregistered Partnership Deed

- Partnership Registered with Registrar of Firm

- Limited Liability Partnership

Partnership Firm Registration

It is not compulsory to register a partnership firm, but advisable. Registering a partnership firm will reduce future complications and can ensure that partners are in agreement with each other, especially when several individuals are involved in the business. Partnership firm registration is fairly easy and most small, medium and unorganized ventures prefer to do so. It can be established by creating the agreement called Partnership Deed. Certified consultants who are experts in company registration process can advise on how to register a partnership firm in Bangalore, Karnataka and other metro cities.

A partnership firm registration appreciates its low cost formation and less compliance as related to Pvt Ltd and LLP. And also it recommends less statutory compliances as compared to private limited company.

Advantages of Partnership Firm

A partnership firm is very simple to establish, the partners just need an agreement between them to start off. Registration is not mandatory and the legal proceeding for registration is negligible. As the legal bindings are less for a partnership firm, the firm can change as when it likes to, the only requirement is that the partners’ mutual consent. This is not so in case of other types of companies like private limited or an LLP. Besides, all these, partnership firms also enjoy more tax advantages than other forms of businesses.

A partnership firm can enjoy capital contribution from multiple members, and this gives them great opportunity to expand their business. Borrowing finances also becomes easier as the institutions have confidence in the firm that their capital is protected not by one but many partners. The funds are less at risk and there are minimal chances that it will go on a loss.

Partners of partnership firms share their high end business thought in order to achieve the growth and management of trade for better decision making and control over the business. More brain power of partnership business can helps to solve the work encountered problems and create good ideas for business improvement.

Partners in a firm can bring different skills required to run the business. Since all of them have equal authority over the business, talent is not concentrated within one person. All of them can take up distinct responsibilities which can result in less conflict in the operations of the business. For instance, while one may be good at accounting and finance, another member can be an expert at marketing and so on.

Reasons to Register a Partnership Firm

1. As mentioned above, a partnership firm is quite hassle-free to register as there are no extensive formalities involved. Registering the firm is not mandatory but a legally registered partnership firm will have an edge in running business over a non-registered one. The registration goes through the Registrar of Firms for verification and approval.

2. The partnership firm can use any name other than a registered trademark name. Since the business is not registered in its name, but in the name of the partners, it can use any name it wishes to. This means that multiple partnership firms can have same or similar names without getting into any legal trouble.

3. A partnership firm is not required to file their books of accounts with the Registrar of Companies every financial year unlike a LLP or a Pvt. Ltd. venture. However, it is advisable that the partners maintain records of financial transactions clearly and take the help of expert accountants to do so. This will make sure that the finances are being used optimally without the scope of mishandling funds.

4. In case of a registered partnership firm, the partnership deed is the ultimate document that lays down the rules for the company. It defines the proportion of profit sharing, ownership rights and duties of the firm’s partners. Hence, there is little scope for partners to get into arguments concerning over basic issues such as their respective roles and responsibilities.

5. A partnership firm can have an account in the bank in it own name. The partners need to submit the deed, be KYC compliant and other necessary documents to the bank. This will ensure that financial transactions are kept separate from personal ones and financial records are easily maintained.

The Partnership deed, generally contains the following particulars:-

- Name of the firm.

- Nature of the business to be carried out.

- Names of the partners.

- The town and the place where business will be carried on.

- The amount of capital to be contributed by each partner.

- Loans and advances by partners and the interest payable on them.

- The amount of drawings by each partner and the rate of interest allowed thereon.

- Duties and powers of each partner.

- Any other terms and conditions to run the business.

Documents Required For Partnership Firm

BY PARTNERS

- PAN Card

- Voter Id / Aadhaar Card

- Driving License / Passport

- Latest Bank Statement / Mobile Bill

- Passport Size Photograph

FOR OFFICE ADDRESS PROOF

- Rental Agreement (In English)

- No Objection Certificate

- Electricity Bill

- Sale Deed / Property Deed

- Tax Paid Receipt ( In case of own property )

Steps to Incorporate a Partnership Firm

The first step to incorporate a partnership name is to finalize a name for the firm. As mentioned above, members are free to choose any name given that it is not offensive or derogatory. The name regulations that are applicable for other types of businesses are not applicable here. But, it is better for partners to choose a name that is distinct from other firms. The partners then have to form an agreement or Partnership Deed. This agreement will contain all necessary information pertaining to the business such as the type of venture, when it is being established, who the members are, their responsibilities, capital contributed by each of them etc.

For Partnership Registration in Bangalore and other cities, members can approach several certified consultants for a nominal fee. They need to apply for PAN and bank account in the name of the business. The documents required for Partnership Firm Registration in India include ID, address proofs of the partners, proof of the registered address for the business, and utility bills like electricity, and telephone etc to complete the process. After verification, the Registrar of Firms will finally issue the Registration Certificate for the partnership firm.

What You will Get After Registered Your Partnership Firm

- Partnership Deed Drafting

- Partnership Deed Attestation

- Partnership TAN

- Partnership PAN

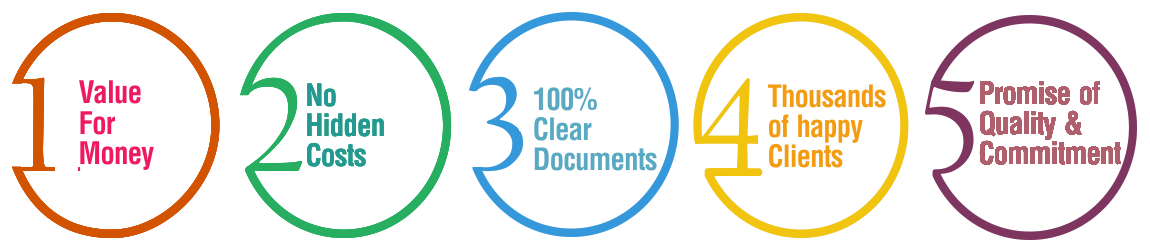

Why Choose BusinessWindo.Com ?