Annual Return / ROC RETURN FILING

Within 7 Days

- Preparing & filing annual returns

- Filing Financial Statements

- Drafting and filing minutes for all meetings

- Preparing share certificates

- Maintaining Statutory Records

- Drafting & filing directors' interests in other entities

- Appointment of Auditors

Annual Return / ROC RETURN FILING

Annual Returns

Annual Return is a significant document for the stakeholders of a company as it provides in a nutshell, very comprehensive information about various aspects of a company. As per Section 92 of the Companies Act, 2013, every company is required to prepare the Annual Return in Form No. MGT-7 and file with the Registrar within 60 days from the date on which Annual General Meeting is actually held or from the last day on which AGM should have been held. As per section 384(2), the provisions of section 92 shall also apply to a foreign company, subject to such exceptions, modifications and adaptations as may be made therein by rules, Rule 7 of the Companies (Registration of Foreign Companies) Rules, 2014 provides that every foreign company shall prepare and file, within a period of sixty days from the last day of its financial year, to the Registrar annual return in Form FC-4 along with fee, containing the particulars as they stood on the close of the financial year.

Signing of Annual Return:

The extract of the Annual Return, which shall be the part of the Board’s Report shall be signed by the Chairperson of the company, if he is authorised by the Board to do so, or where he is not so authorised, by at least two directors, one of whom shall be a managing director, or by the director where there is one director

The Annual Return Consist of the following documents:

- The Balance Sheet of the Company

- Profit & Loss Account

- Compliance Certificate

- Registered Office Address

- Register of Member

- Shares and Debentures details

- Information regarding the Management of the Company.

The documents needs to be e-filed with the RoC are as follows:

- Financial Statements which includes

- Auditors Report & Annexure

- Balance Sheet

- Statement of Profit & Loss

- Cash Flow Statement (if Turnover more than Rs. 2.00 Crore and Paid up capital Rs.50.00 lacks)

- Schedule of the accounts

- Details of Meeting held during the year

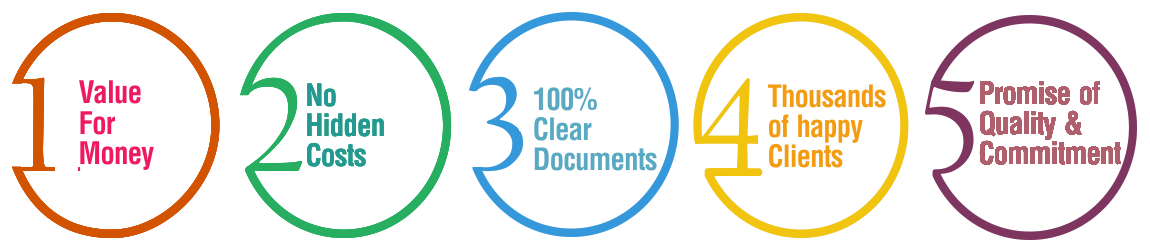

Why Choose BusinessWindo.Com ?