A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_URI::$config is deprecated

Filename: core/URI.php

Line Number: 101

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Router::$uri is deprecated

Filename: core/Router.php

Line Number: 127

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property Article::$benchmark is deprecated

Filename: core/Controller.php

Line Number: 75

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property Article::$hooks is deprecated

Filename: core/Controller.php

Line Number: 75

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property Article::$config is deprecated

Filename: core/Controller.php

Line Number: 75

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property Article::$log is deprecated

Filename: core/Controller.php

Line Number: 75

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property Article::$utf8 is deprecated

Filename: core/Controller.php

Line Number: 75

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property Article::$uri is deprecated

Filename: core/Controller.php

Line Number: 75

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property Article::$exceptions is deprecated

Filename: core/Controller.php

Line Number: 75

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property Article::$router is deprecated

Filename: core/Controller.php

Line Number: 75

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property Article::$output is deprecated

Filename: core/Controller.php

Line Number: 75

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property Article::$security is deprecated

Filename: core/Controller.php

Line Number: 75

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property Article::$input is deprecated

Filename: core/Controller.php

Line Number: 75

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property Article::$lang is deprecated

Filename: core/Controller.php

Line Number: 75

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property Article::$load is deprecated

Filename: core/Controller.php

Line Number: 78

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property Article::$db is deprecated

Filename: core/Loader.php

Line Number: 390

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_DB_mysqli_driver::$failover is deprecated

Filename: database/DB_driver.php

Line Number: 371

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Return type of CI_Session_files_driver::open($save_path, $name) should either be compatible with SessionHandlerInterface::open(string $path, string $name): bool, or the #[\ReturnTypeWillChange] attribute should be used to temporarily suppress the notice

Filename: drivers/Session_files_driver.php

Line Number: 132

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Return type of CI_Session_files_driver::close() should either be compatible with SessionHandlerInterface::close(): bool, or the #[\ReturnTypeWillChange] attribute should be used to temporarily suppress the notice

Filename: drivers/Session_files_driver.php

Line Number: 290

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Return type of CI_Session_files_driver::read($session_id) should either be compatible with SessionHandlerInterface::read(string $id): string|false, or the #[\ReturnTypeWillChange] attribute should be used to temporarily suppress the notice

Filename: drivers/Session_files_driver.php

Line Number: 164

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Return type of CI_Session_files_driver::write($session_id, $session_data) should either be compatible with SessionHandlerInterface::write(string $id, string $data): bool, or the #[\ReturnTypeWillChange] attribute should be used to temporarily suppress the notice

Filename: drivers/Session_files_driver.php

Line Number: 233

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Return type of CI_Session_files_driver::destroy($session_id) should either be compatible with SessionHandlerInterface::destroy(string $id): bool, or the #[\ReturnTypeWillChange] attribute should be used to temporarily suppress the notice

Filename: drivers/Session_files_driver.php

Line Number: 313

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Return type of CI_Session_files_driver::gc($maxlifetime) should either be compatible with SessionHandlerInterface::gc(int $max_lifetime): int|false, or the #[\ReturnTypeWillChange] attribute should be used to temporarily suppress the notice

Filename: drivers/Session_files_driver.php

Line Number: 354

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: Warning

Message: ini_set(): Session ini settings cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 337

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: Warning

Message: session_set_cookie_params(): Session cookie parameters cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 344

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: Warning

Message: ini_set(): Session ini settings cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 359

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: Warning

Message: ini_set(): Session ini settings cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 369

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: Warning

Message: ini_set(): Session ini settings cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 370

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: Warning

Message: ini_set(): Session ini settings cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 371

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: Warning

Message: ini_set(): Session ini settings cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 372

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: Warning

Message: ini_set(): Session ini settings cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 430

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: Warning

Message: session_set_save_handler(): Session save handler cannot be changed after headers have already been sent

Filename: Session/Session.php

Line Number: 110

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: Warning

Message: session_regenerate_id(): Session ID cannot be regenerated when there is no active session

Filename: Session/Session.php

Line Number: 185

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: Warning

Message: session_start(): Session cannot be started after headers have already been sent

Filename: Session/Session.php

Line Number: 186

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property Article::$session is deprecated

Filename: core/Loader.php

Line Number: 1290

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Loader::$benchmark is deprecated

Filename: core/Loader.php

Line Number: 925

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/application/controllers/Article.php

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Loader::$hooks is deprecated

Filename: core/Loader.php

Line Number: 925

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/application/controllers/Article.php

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Loader::$config is deprecated

Filename: core/Loader.php

Line Number: 925

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/application/controllers/Article.php

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Loader::$log is deprecated

Filename: core/Loader.php

Line Number: 925

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/application/controllers/Article.php

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Loader::$utf8 is deprecated

Filename: core/Loader.php

Line Number: 925

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/application/controllers/Article.php

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Loader::$uri is deprecated

Filename: core/Loader.php

Line Number: 925

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/application/controllers/Article.php

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Loader::$exceptions is deprecated

Filename: core/Loader.php

Line Number: 925

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/application/controllers/Article.php

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Loader::$router is deprecated

Filename: core/Loader.php

Line Number: 925

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/application/controllers/Article.php

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Loader::$output is deprecated

Filename: core/Loader.php

Line Number: 925

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/application/controllers/Article.php

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Loader::$security is deprecated

Filename: core/Loader.php

Line Number: 925

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/application/controllers/Article.php

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Loader::$input is deprecated

Filename: core/Loader.php

Line Number: 925

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/application/controllers/Article.php

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Loader::$lang is deprecated

Filename: core/Loader.php

Line Number: 925

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/application/controllers/Article.php

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Loader::$load is deprecated

Filename: core/Loader.php

Line Number: 925

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/application/controllers/Article.php

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Loader::$db is deprecated

Filename: core/Loader.php

Line Number: 925

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/application/controllers/Article.php

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

A PHP Error was encountered

Severity: 8192

Message: Creation of dynamic property CI_Loader::$session is deprecated

Filename: core/Loader.php

Line Number: 925

Backtrace:

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/application/controllers/Article.php

File: /home/y1pwoa10zant/public_html/businesswindo.com/info-cafe/index.php

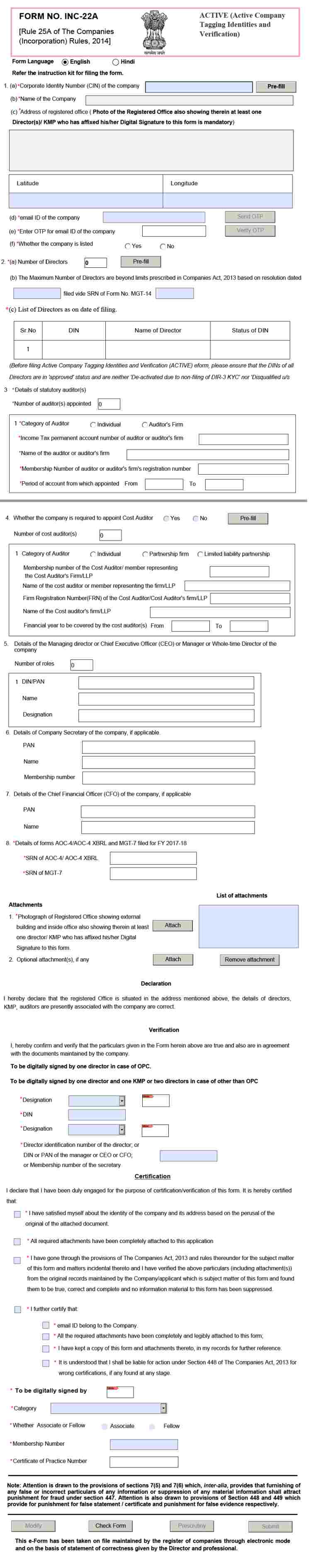

E-Form Active by Filing of INC-22A

E-Form Active by Filing of INC-22A

Posted on: 2019-03-09 02:42:11

MCA has introduced a new e-form INC 22A to update the KYC details for all types of companies registered with MCA. All particulars including company registered office has to be file in this form to mark as active status ok and it is mandatory for all entities.

The Ministry of Corporate Affairs has notified the Companies (Incorporation) Amendment Rule, 2019 ; under which all the companies who have registered/ incorporated on or before 31st December 2017; are required to file e-FORM ACTIVE (Active Company Tagging Identities and Verification) in INC-22A Form on or before 15th June 2019; but earlier it was 25th April 2019. Please, don't be confuse.

The purpose of e-Form ACTIVE is to update the details of the company so that it would not be treating as inactive.

Due date for filing of e-Form ACTIVE INC-22A The company incorporated before December 31, 2017; are needed to file eForm INC-22A on or before June 15, 2019. The government has extended the deadline of E-Form Active to 15th June 2019. So that the companies can get time to comply with their provision.

Consequences of noncompliance/ non filing of e-Form INC-22A If you are failure to file e-Form ACTIVE in time and doing it same later, you’ve to pay a penalty of Rs. 10,000 as late filing.

And if you’re not filing/ complying this form, the company will be marked as “ACTIVE Non-Compliant” in MCA Master Data.

What shall be the effect of ACTIVE Non-Compliant? After declaring the company as ACTIVE Non-Compliant, it couldn’t be able to manage/ operate these following key things:

Can’t make changes in capital structure Can’t go ahead with merger/ amalgamation deals Can’t rotate its director Can’t changes its registered office Can’t file the annual forms

Who shall not be allowed to file e-Form ACTIVE? The companies who’ve not filed/ update the following things are restricted from filing of e-Form ACTIVE. For this, the company has to file the details with Registrar first, then they can move for filing of INC-22A.

Company financial statements towards ROC for FY 2017-18 If the DIN status of any Director is not approved If ADT-1 is not filed for 2018-19 If the number of Directors is less than the minimum under prescribed Act

Who are exempted from filing of e-Form INC 22A ACTIVE? According to the notification of MCA, these companies are not required to file the ACTIVE Form:

Struck off company Under processing of striking off companies Under liquidation companies

Mandatory documents required to attach in eForm INC-22A Photographs of registered office showing the external building and inside office with presenting at least one director therein

Particulars required for filing of eForm INC-22A

Email ID of company and generated OTP to mail Name of all Directors of the company with DIN status active Details of Statutory Auditor/ Cost Auditor Details of CEO, CFO and if any Details of Company Secretary if paid up capital is Rs. 5 crores or more

Look at the info image of FORM NO. INC-22A , you'll get a clear-cut idea about what it is. And will have to fill the mandatory fields as well as optional to make your company as ACTIVE.

-----------------------------------------------

Read On More:

ISO Standards Certification

How to Get Trade License in Bangalore?

How to Start a Startup in Bangalore?

How to Register a Company in Bangalore India?