Service Tax Returns

Within 7 Days

Service Tax Returns

Service Tax Returns

Every person who has obtained a service tax number should file a service tax return. Payment of tax must be done before filing of returns.

E-filing of service tax return is allowed by the service tax department If you have have no operations in a particular quarter, a NIL return must be filed.

Once you have obtained a service tax number, filing is a must irrespective of the business activities.

How do I file service tax returns?

1. All you have to do is fill a simple form on the website and give us some essential information like your company balance sheet, the state you carry out your operations in, ST number, tax liability details etc.

2. We will prepare an authorization letter which you need to sign.

3. Thereon, we will submit your duly filled-in application to the Department of service tax. Upon successful completion of the process, we will mail you the Verification acknowledgment form to your registered email address.

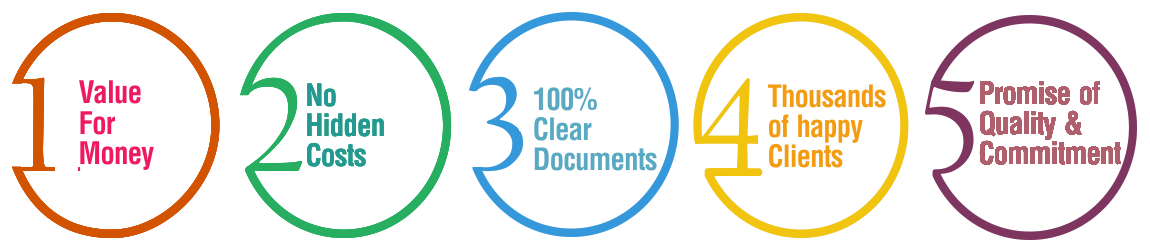

Why Choose BusinessWindo.Com ?