VAT Returns

Within 7 Days

VAT Returns

VAT Returns

VAT is collected and governed by the State Government , so each State Government in India has distinct rules applicable for their State based on the type of good manufactured or sold Value Added Tax (VAT) Registration is a tax registration required for businesses trading or manufacturing goods in India.vat also erroneously known as TIN and CST. Returns need to be filed on the 20th of each month (partnerships, LLPs and proprietorships can do so quarterly) Registration of VAT is ultimately borne by the consumer. VAT is collected by the state government and it is essential to know what the VAT rate is for the type of good or service you provide in each state you provide it in

When is VAT applicable ?

VAT registration is required for any business that is into sales either by way of trading, manufacturing etc. Vat registration is compulsory when you cross a specified turnover.

To whom is VAT applicable ?

VAT is applicable to all i.e. Proprietary, Partnership, Private Limited as the case

How do I get registered under VAT ?

All you have to do is fill a simple form on the website and give us some essential information of your line of work/business.We will prepare an authorization letter which you need to sign.Thereon, we will file the required documents with the Department of Commercial Taxes.Thereafter you will be issued a TIN number accompanied by a certificate of company VAT registration by the department.

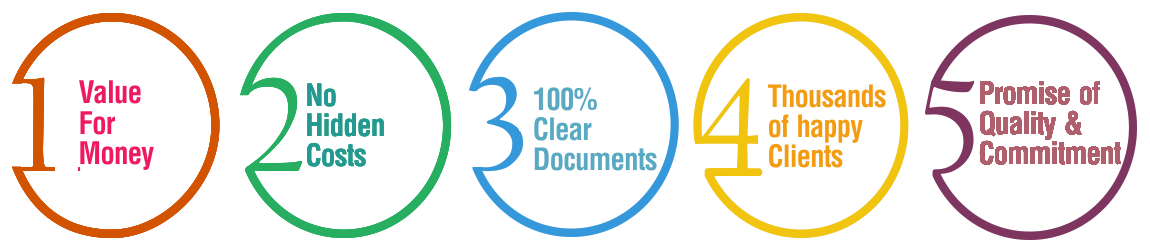

Why Choose BusinessWindo.Com ?