Info-Cafe

Results for : All categories

Results for : All categories

Difference between LLP (Limited Liability Partnership) and Private Limited Company

A lot of entrepreneurs in India want to form a private limited company. At the same time there are also some businessmen who wish to set up a limited liability partnership company. They are always curious regarding how both these types of business entities compare. It needs to be said in this context that both the entities have a number of features that are similar to each other and come in handy when it comes to running small and large businesses, but there are several areas where they differ significantly from each other.

So here you can look over the comparison chart of LLP and Pvt Ltd and find the distinction between them for getting your knowledge overview.

|

Basic Comparison |

LLP |

Private Company |

|

Meaning |

LLP is a form of business which combines the features of partnership and body corporate. It protects partners for arising negative issue |

A private company is a company which is owned and traded privately. It is ideal for anyone who is looking to raise capital from external sources |

|

Registration |

Mandatory registration required with ROC State Government |

Mandatory registration required with ROC Central Government |

|

Governed By |

Limited Liability Partnership Act, 2008 |

Indian Companies Act, 2013 |

|

Name |

Name of the company end with “LLP” as Limited Liability Partnership |

Name of the company ended with “Private Limited” or “Pvt Ltd” |

|

Minimum Directors/Designated Partners |

2 |

2 |

|

Number of Partners/ Shareholders |

Minimum 2 partner for llp. No maximum limit |

Minimum 2 shareholders in private company. Maximum up to 200 shareholders are allowed |

|

Minimum Paid Up Capital |

Not Specified by MCA |

1 lakh |

|

Legal Entity Status |

LLP is a separate legal entity apart from directors/ partners |

Pvt Ltd is a separate legal entity apart from directors/ shareholders |

|

Liability of LLP Partners/ Shareholders |

Liability of partners shall be limited except in case of unauthorized acts, fraud and negligence |

Shareholders shall be limited to the extent of the unpaid capital |

|

Foreign National as Partner/ Shareholder |

Foreign national can be Designated Partners |

Foreign national can be shareholders and Directors |

|

Taxability |

LLP taxed at flat 30% AMT |

The income of pvt company is taxed at flat 25% MAT |

|

Board Meetings |

Not mandatory |

Quarterly Board of Directors meeting, annual shareholders meeting is mandatory. |

|

Company Annual Return |

Annual statement of accounts and solvency & annual return has to be filed with ROC |

Financial Statements and annual return to be filed with ROC |

|

Audit Requirement |

Not mandatory Unless annual turnover exceeds Rs. 40 lakh and contribution exceeds Rs. 25 lakhs |

Mandatory |

|

Foreign Investment |

It is acceptable |

It is acceptable |

The process of registration

Normally, the processes of registering both these kinds of companies are pretty similar with some differences in terms of forms and documents being filed for the process of incorporation. If you wish to incorporate a limited liability company you will need at least two shareholders. In case it is a private limited company you would not be allowed to have more than 50 shareholders. In case of a limited liability partnership you will need to get at least a couple of partners. However, there is no upper limit for the partners that can form such a company. Even a corporate body can become a member of a limited liability partnership as well.

You can always update your information regarding LLP Vs Pvt Ltd from the internet as well as any other trusted source that you may have. In the first step of incorporating a limited liability partnership you have to apply to get the designated partner identification number (DPIN) from the concerned authorities. This designated partner identification number will come in handy for the designated partners of the company thus formed. You also need to get a digital signature for one of the partners.

On the other hand, in order to form a private limited company you first need to decide the name of the company to be. After this, you should apply for the digital signatures as well as the designated partner identification number. This is important information pertaining to private limited company registration. It is in the second stage of incorporating a limited liability partnership that you decide the name of the company and get the same on the basis of availability. In the second stage in case of a private limited company you need to draft the memorandum and articles of association.

In the third stage of LLP registration you draft the limited liability partnership agreement for the company in question and then file the incorporation document. This comprises Forms 2, 3, and 4 that can be downloaded from lip.gov.in. After filling up the forms they need to be handed over to the Registrar of Companies. In case of a private limited company there are some different processes involved. You need to stamp, digitally sign, and e-file the memorandum and articles of association along with e-forms 1, 18, and 32. This needs to be done in accordance with the Companies Act, 1956 as well as other documents that are mentioned in the articles of association that you have provided to the Registrar. The final stage sees the procurement of the respective certificates of registration.

-----------------------------------------------------

Also Read:

Which Corporatization Entities Should I Choose for My Business?

When you are starting out on a business there are plenty of things in your mind – there are lots of decisions that have to be taken. One of the most-important decisions that you will ever take as a businessman is the kind of legal structure that you want for your business. Before you take any decision as such do remember that whatever type of company you form it will have an impact on several areas of business. You might want to form a private limited company (Pvt Ltd) but do so with great thought.

Because you know your business can be the most valuable player in your entity and can put an effective mark to your brand. So it is crucial to choose wisely the entity type or model that's best match for your business.

You could find the top 6 business structure option in India such as -

- Public Limited Company

- Private Limited Company

- Limited Liability Partnership

- One Person Company

- Partnership

- Sole Proprietorship, for taking into the mind in your business journey;

How is business affected by legal structure of a company?

A lot of entrepreneurs want to set up a limited liability partnership company (LLP). First of all, the kind of company structure that you choose would determine the amount of paperwork that you have to do before you get it up and running, and afterwards as well.

It will also determine the amount and kinds of taxes that you are asked to pay. The legal structure would also decide the extent of personal liability that you have to face as the owner of the business. It will also decide how well you are able to raise money for your business.

Which one is the best?

Anyone might tell you that a one person company (OPC) is the best option going around while others might give you other names. However, you need to keep in mind the simple fact that it all depends on the circumstances that the business owner finds himself in.

It is always subjective and unique in that sense. It all depends on what you can do. Therefore, any assumption that one form of business is better than the other is always a wrong one. This is why decision to start a company needs to be taken with a lot of thought.

Taking it slow

Experts will always tell you to take your time and make decision before you are going to form a public limited company or any other form of company for that matter. It is always better to get all the advice and suggestions that you can from business experts before you get started with your firm. Each and every business has its pros and cons and you need to know them before you take a decision as such.

If you take a good look around you, you would come across businessmen who always wish they had formed some other type of company. It is important that you do not have the same experience as well.

Getting the information

You might want to form a partnership company or a sole proprietorship company. But before you take any step please go and get information.

The people you read in the previous paragraph who are about to forming their business are basically ones who chose to ignore this important truth of doing business – looking before you leap. But they believe in the scope, need and market study and requirements idea on that business.

There are plenty of sources from where you can get information and help regarding consultation on business formation. Due to some reasons, if you are unable to visit an expert, you can always look up the internet and read up as much as you can and contact them to get the clear idea on the different kinds of business entities as well as their positives and negatives.

-----------------------------------------------

Read More:

Steps to Setup a New Startup in Bangalore

How to Register a Company in Bangalore India

20 Small Business Ideas to Start with Low Investment

Annual Return Filing for Companies Under The Compliance of 2013

The Companies Act, 2013 represents a significant shift in requirements compared to the Companies Act, 1956. From the 2014-15 financial year the Companies Act, 2013 will be followed. The new yearly forms are also expected to be prepared as per the new requirements that come into being as a result of the introduction of the new law. It can be said with a degree of certainty that the new compliance rules are absolutely different from how they were under the Companies Act, 1956. For example, a number of new clauses have been introduced in the segment named Director’s Report. Some of those areas may be mentioned as below:

- Disclosure of Sexual Harassment Act

- Dates of board meetings that were organized during the financial year

- Number of board meetings that were attended by the directors

Changes in annual return

As far as annual filing is concerned, there have been a few changes. Previously, the e-form named 20B was used in order to prepare the annual return under the previous system. A new form named MGT-7 has come into being now. Compared to the previous yearly return completed under Schedule V the new form is quite lengthy. There is a couple of provisions that are related to annual return. One of them is named signing and the other one is named certification.

Changes in financial statement

Earlier on, as part of the Companies Act, 1956 companies were supposed to prepare a balance sheet as well as a statement of profit and loss account as part of their annual reports. There have been some company annual filing changes in this case as well. The Companies Act, 2013 has also added a consolidated financial statement and a cash flow statement to the said mix. Only the one person companies (OPCs) and smaller companies have been exempted from the requirement pertaining to a cash flow statement.

Changes in secretarial standards

As of 1 July 2015 all companies would have to conduct their meetings in accordance to provisions that have been mentioned in the Secretarial Standards and Companies Act, 2013. It is expected that there would be some significant changes when it comes to annual return filing for company. In case of the one person companies the director will have to disclose details regarding any interest he may have in any other business entity. This will have to be done in the first meeting of the board of director.

More changes on the way

The directors of the one person companies will also need to submit new MBP-1 forms as and when his business interests differ from what he had furnished in the previous form of the same name. They would also need to submit disclosures of non-disqualification each and every financial year. The case of annual general meetings will perhaps not apply for the one person companies though since they have only one individual who is doing all the stuff. They will also need to file their annual returns within 60 days of entering their ordinary resolution in their minute books.

-----------------------------------------------

Also Read:

Know about Chartered Accountant Services in Bangalore

Why Are Most Entrepreneurs Opting for Private Limited Company?

Starting a company can be one of the most rewarding and interesting things that someone may have done in his life. One of the most-important decisions that you as an entrepreneur can make is the kind of company that you wish to form. This is an important part of starting the journey. The kind of business entity that you choose could go a long way in determining what happens to your company in the long term. This is why it is always important that you discuss your business plan with someone – preferably a person who happens to be a professional in such matters. Ideally the type of company that you choose to go with should be one that supports your business vision. It is important that you know how to register a Pvt Ltd company.

Building a great team

With private limited company registration you can easily form a great team that takes your business to new heights. Anne M Mulcahy says that, and rightly so, employees are the best assets of a company. They give you the competitive edge that helps you perform much better than your rivals. As a business it is your responsibility to attract the best talent and retain them as well. You need to keep on encouraging them as well.

Encouraging the employees

You have to give your employees all the stimulus that you think they might need. After all, it is these employees that would look after important work such as private limited company registration. Mulcahy also says that you need to make them feel as if they are integral parts of the company where they are working. When they feel that are important cogs in the wheel they will work hard to make sure that the company is doing well. Without fail, every company that has succeeded has done so because of the fantastic teams that have worked for them.

The importance of teamwork

It is teamwork that can make sure that processes such as registration of private limited company get over without much problem. Gone are the days when a company would become successful because of a single person. As soon as you are able to set up good teams you will find success as a company and grow to the extent that you have envisaged for yourself. These days, people who are skilled and experienced in their respective domains are looking for much more than the fat paycheck.

What are the employees looking for?

You can get information on Pvt Ltd registration in Bangalore on the internet. This is the reason why the companies are offering several benefits in order to attract the best employees and retain them as well. They are looking at ways such as stock ownership, training sessions on a regular basis, and flexible timing and working arrangements. Among all the benefits on offer stock ownership seems to be the best one on offer. It is a lucrative proposition for people who are working in a company as well as ones who are looking to join the same. Stock ownership makes you feel important

Guidelines for Company Registration in Bangalore - Register Your Company in a Jiffy

Business ideas in Bangalore call for well-thought of plans and intelligent decisions. Small or big start-ups, all need sharp thinking, depending on the demand of the product and the supply chain management that is predominant in the city. Depending on the cost of living and other resources, plan your business ideas accordingly. Regulatory formalities requiring compliance with various labour and environment laws are time consuming and difficult in nature. Often, new and small firms are unaware of nuances of the issues and can be subjected to intrusive action by regulatory agencies. In order to make compliance for Startups/ new registered companies friendly and flexible, simplifications are required in the regulatory regime.

In order to commence operations, companies require registration with relevant regulatory authorities. Delays or lack of clarity in registration process may lead to delays in establishment and operations of Startups, thereby reducing the ability of the business to get bank loans, employ workers and generate incomes. Enabling registration process in an easy and timely manner can reduce this burden significantly. Once you have done that, you have to venture out into capital and business development. Company registration in Bangalore is simple; however, there are certain legal aspects of it, which need to be kept in mind.

While you can opt for online registration, you can also hire agencies which can help you company registration. It is recommended to opt for the latter as there are number of requirements when it concerns starting a company in Bengaluru. Therefore, professional agencies can help you in finding legal lawyers, chartered accountants, and company secretaries. These agencies also help in accounting, preparing legal documents, business connections, trademark, and advisory services. These services, actually, help in providing end-to-end solutions in life cycle of business venture.

There is no necessity of visiting the corporate office for registering a start-up or a new company. You can actually register it online, sitting in the comforts of your home. In fact, the registration also includes registration like Digital Signature Certificate (DSC), Director Identity Number (DIN) and filling up an e-form.

Before registering the company, the director should acquire an identification number, which can be done by filing an eForm DIN-1. The second step involves acquiring the digital signature certificate. In order to ensure the security and authenticity of documents filed electronically, a valid digital signature is submitted electronically. The signature should be acquired by only those agencies that are appointed by the controller of certification agencies. The signatures can be obtained from TCS, IDBRT, MTNL, SAFESCRYPT, NIC, nCODE Solutions etc.

The third step for business registration includes creating an account on MCA portal. This will enable you to pay the online fee. This is free of cost and all you have to do is click on the registration link.

The final and the most important step include incorporating the company name, registering the office address, notice for the appointment of the company directors, managers and secretary. The form will also include the take and pay for their qualification shares. For each of the above-mentioned sections, you have to apply in Form INC-1, E-SPIE 32, E-SPIE -33 & E-SPIE- 34.

Some of the other things that have to be kept in mind while registering a company include:

- Obtaining a TAN number

- Documents complying with shop and establishment acts

- PAN number

- RBI approval for foreign companies investing in India

- In case of foreign trade, registration documents of import export code from the Director General of foreign trade

- In case any borrowings to be made from outside India or applying for External Commercial Borrowing, FIPB approval required (Foreign Investment Promotion Board)

- Any Investments if parked abroad required RBI approval for ODI (Overseas Direct Investments)

It is to be ensured that both Indian and foreign directors need to have valid Digital Signature Certificates from authorized agencies.

Stuttering Startups: Legal Hazards You May Want To Avoid

Starting a “startup” and running the business would bring up several challenges throughout. It is common to face failure at the beginning of any enterprise. As an entrepreneur, your tenure would be marked with initial hiccups and hit-n-miss opportunities. Legal matters are one of the leading junctures which an entrepreneur often overlooks, often leading to hassles later on. Besides giving shape to your startup, you need to keep yourself updated on legal steps, to ensure a smooth-sail into progress. Here are some of the points you should learn about:

Choosing the legal structure of the startup

Your future plans would depend heavily on the legal structure of your startup. It has an impact on the kind of investors you can accept, your tax liability, your personal legal liability, and so on. By selecting the wrong kind of structure you might end up with unlimited personal liability for debts incurred by your company .So, you need to keep various factors in consideration, which include: type of business, administration control, tax registration, management and ownership, funding, profit sharing, business regulatory and many more like this.

Business registration

In India, business registrations and licenses are extremely important to operate a business lawfully in a territorial jurisdiction. It may include com VAT registration, PAN registration, TAN, service tax registration, etc. Unless it happens, the entrepreneurial venture could become a subject of scrutiny under government authorities. Also, shareholders need to be kept in mind as often frauds and breech in agreement often happen due to lack of shareholder’s agreement. It is of essentiality to have a shareholder’s agreement, even if the people in question are friends or family members

Trademark registrations

One of the common mistakes that startups commit is by not registering their trademarks. This can turn to be costly as to survive in a competitive market, organizations often end up stealing ideas and other entities. You must protect your intellectual rights, not only for yourself but also for the organization as a whole. Go for the trademark registration and bear the responsibilities of an owner.

Avoid loose language

In the rage of marketing, some people commit grave mistakes of promoting overblown or exaggerated advantages of their product or services, which has unprecedented negative outcomes. Fraudulent cases are rampant, with consumers being smart enough to take the organization to court. Therefore, you should not opt for a loose language while describing the products and services that are utterly false. A carefully thought campaign would benefit on the longer run.

The legal jurisdiction has brought forwards great deal of reformation, in context to employees and their rights. . Failing to adhere to employee laws in regards to vacations, sickness and disciplinary action can result in a court case. It’s of essentiality to keep yourself abreast about employee rights to prevent any nasty occurrences down the line. Cases of bullying and sexual harassment in workplace, often lead to the strictest punishment being awarded. The goodwill can only be maintained through satisfied employees.

Do not miss out the evidence

Legal issues crop up due to employee disagreements, client satisfaction and so on. By not keeping evidence, you are bound to be at the defeated end. The most positive thing in this instance is reverting to complaint with evidence, putting your case across. Every business related decision needs to be documented in writing. Contracts, emails, and even note-taking apps are aids for you to prove innocence. It is always preferable to have proof to strengthen your case.

Agreements with a third party

While you negotiate for a third-party agreement, you should also include a non-disclosure agreement, which protects your rights of intellectual property. It should highlight all the points of agreement in the case of a breach, dispute or termination occurs. At the end, you will have proper documentation that prevents any harm to your startup.

Why your business needs Trademark Registration? How Trademark is important for your business?

When you are looking to start your own business, one of the first things that you will need to arrange for is the trademark for your company or enterprise. Trademark registration is a crucial aspect of your business as it makes your brand an official identity. Your target customers are going to make important purchasing decisions based on your trademark and the reputation of your brand. Therefore it is necessary that you put special importance on registering your trademark from the beginning. Here are some reasons why registering trademark is important for your business.

Trademarks make a brand unique and distinct from other brands in the market

Your trademark makes your brand unique and different from others within the same industry. This makes your brand immediately recognizable and identifiable for your target customers. In today’s world where business firms face a lot of competition from their rivals, it always helps to stand out and grab the attention of your target customers easily. For a customer, a trademark makes it possible for them to immediately know the company they are dealing with and the quality of services or products that they are likely to get.

Trademarks function as important communication tools

Trademarks always serve as effective communication tools for a business organization. When it comes to your brand, the trademark can communicate specific emotional and intellectual messages and attributes regarding you, your organization and the products and services offered by your company. In short, it can shape up your company’s reputation and determine how your target customers think about your brand or business. The best thing about a trademark is that it does not even need to be a single word. You can also choose a specific design or logo that can be identified by all customers.

Trademarks are considered to be valuable assets

Your company’s trademark can grow in value over time. As you are able to grow your business reputation, your trademark will increase in its value. By having a proper trademark in place, you can actually expand your enterprise further over time. Eventually you can use your trademark to merge with another company should you want to enter a partnership.

Trademark makes it easier for companies to make the best use of digital marketing

When you are looking to promote your company through social media platforms or the search engine, you will need to make sure that your brand is immediately recognizable by your customers. Having a distinct trademark allows you to do just that. By having a trademark for your brand, you can promote it effectively to get higher traffic rate for your site or social media profiles which will certainly help you earn greater revenues.

Trademarks help in recruiting employees

When you are looking to hire new employees, it will be easier for you to find prospective candidates since they are already familiar with your trademark and brand. Every individual wants to work for a high profile company and your trademark will ensure them that their careers are in good hands.

--------------------------------------------------------

Related Posts:

Why Trademark is Vital for My Business?

Difference between Registered & Unregistered Trademark

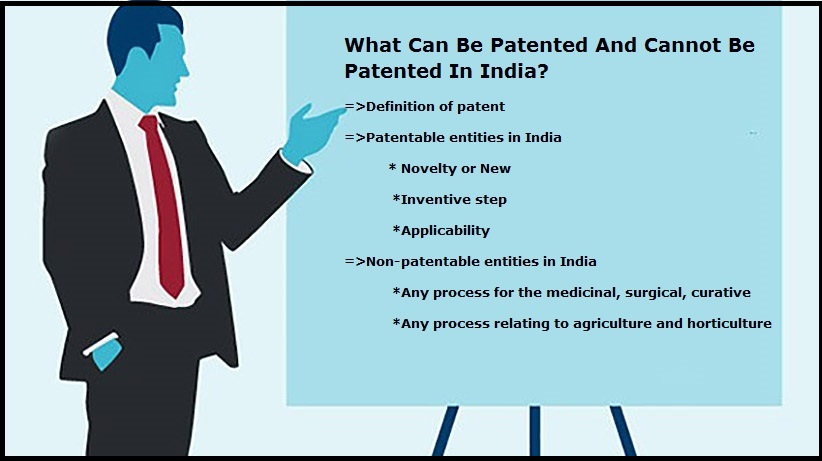

What Can Be Patented And Cannot Be Patented In India?

Brought up first in the year of 1856, the Patent Law in India permitted new manufacturers to a certain set of privileges for a period of up to 14 years. From then onwards, new laws were introduced, amended, repealed and rest still in effect. Interestingly, the Indian parliament has failed to define the term “Patent,” leading to an ambiguous understanding in people. Consequently, this failure of providing the definition in the Indian Patent Act was largely criticized.

To be very clear from the start, it is almost impossible to distinctively identify what and what cannot be patented. However, there are specific mentions in the law that doesn’t permit patentability to a so-called invention. Let us proceed steadily on what’s what about patentability in India.

Definition of patent

An inventor of a process, product or solution receives the exclusive rights for his/her invention for a specific period of time from a sovereign state. During this period, it protects the invention from being used, manufactured or sold as it violates the rules of a patent under Section 3 and 4 of the Act.

Patentable entities in India

An invention can be brought in for patent registration under the Indian Patent Law only if it qualifies certain criteria, in terms of its novelty, inventive step and industrial applicability. As mentioned in several articles also, these three terms are the basis for granting an invention a patent status.

Further defining them in simple terms:

- Novelty or New – Nowhere an “invention” would be considered for the exclusive rights of a patent if it has already been in the public domain or included in any publication worldwide. Complete novelty is the first criteria and the invention has to qualify this for being accepted for a patent status.

- Inventive step – It encompasses two conditions: The first that the invention adds a feature to the already existing knowledge of techniques and has economical significance or both. Second, it shouldn’t be an obvious thing for a person who is skilled in the art.

- Applicability – It should have an industrial applicability.

- Invention – It shouldn’t violate the provisions of Section 3 and 4 of the Indian Patents Act, 1970.

Now that we have explained in the above, we would also like to add that these definitions are also quite contested in the court of law. Therefore, people should hire legal help to manage with these matters.

Non-patentable entities in India

Here again, there is a list of exclusions that doesn’t allow an invention to get patented. The following briefly points out the scope of non-patentability:

- Any frivolous idea that stands opposite to the established laws of nature and public health cannot be granted a Patent status.

- Any invention that proves fatal or detrimental for human, plant or animal life cannot be considered for patentability.

- Machines, which can be arranged and rearranged individually, run in a new way cannot be acceptable as an invention.

- An invention from the traditional knowledge, which already has been known in any form cannot receive the status of patentability.

- Artistic, dramatic, literary or musical work, cinematographic works, television productions does not comply with the criteria.

- A newly substance made from existing substances yet not increasing its efficacy has no qualifications as an invention.

- Mixing two or more substances that merely results in its aggregation of properties do not receive approval for patentability.

In the above, there are also certain conditions that are still debatable and found inconclusive. Hence, a legal expert can guide better.

What is the validity period of patent?

Every patent license for a divisional application is valid for 20 years from the date of filing of patent application, which filed in national phase application under Patent Cooperation Treaty (PCT). And the term of patent shall be 20 years from the international filing date under PCT.

Who can apply for a patent?

A true and first inventor or his/ her assignee, either alone or in cooperation with any other person can be filed a patent application in respect of the original invention. But a legal delegate of deceased person can also formulate an application for patent.

Assignee can be a natural person, rather than legal person such as a registered company, a research organization, an educational institute or Government.

Assignee includes the assignee of an assignee also.

When an application needs to be filed for a patent?

A patent application shall be filed to the Intellectual Property India through the appropriate jurisdiction of Patent Office by disclosing the essence of the nature of the invention which helps to register the invention on priority basis.

The application should be filed from the earliest dates of invention and it should not be delayed.

Delay in filing may arise certain risks such as (a) some other inventor might file a patent application on said invention or (b) may be someone has applied for that but not taking any care to process for publication.

------------------------------------------------------------------

Also Read More On:

Why Your Business Needs Trademark Registration?

Why Trademark Registration is Vital for My Business?

All You Need To Know About GST (Goods and Services Tax)

The goods and services tax (GST) is expected to come into play from 2017 onwards with the constitutional amendment bill for the same having been passed by the President of India. It was passed in the parliament before the presidential approval came about. Rajya Sabha passed it on 3 August 2016 and Lok Sabha did the same on 8 August 2016. At least half of the state governments have ratified it as well. The Indian Government is committed to make sure that it is implemented by April 2017. As and when this tax comes into being all the indirect taxes applied on goods and services by the different states and the centre would be replaced by it.

What does this tax imply?

It is expected that when the goods and services tax come into being it will widen the tax base. Then, almost any and every good and service would be subjected to taxation – perhaps there would be no exemptions. It is expected that it will benefit Indian economy in a significant way and create a common market. Experts also feel that the effects that taxes normally have on goods and services would be mitigated significantly by this tax.

What will it effect?

It is expected to have an effect on a number of areas related to taxes. They may be enumerated as below:

- Structure

- Incidence

- Computation

- Payment

- Compliance

- Reporting

- Credit utilization

It is in fact being expected that the entire structure of indirect taxes would be changed because of the goods and services tax. Goods and services tax is also expected to have a major impact on each and every aspect of how business is done in India. This includes how products and services are priced, and how supply chains are optimized. Areas such as business income tax, tax compliance systems, and accounting are to be impacted as well.

How will business change in India after goods and services tax?

It is expected that after goods and services tax comes into being there would be greater advocacy for practices that are best for business. Companies would have no option but to gear up for the various changes being made to business processes. They would have to develop training teams and also come up with income tax systems that would help them to be compliant with the new system. These are undoubtedly going to be some of the most important areas.

How will companies cope?

As the government is gearing to implement goods and services tax by April this year, the first thing that companies need to do is become compliant with the new system. This will also give them some time to test the various changes that may happen to the system as a result of the introduction of the said tax regime. The extent of changes would also depend significantly on factors such as the size of area that the concerned company is operating in, as well as the sector and scope of operations.

The companies may need to have an action plan that follows a certain time limit, and they also need to be proactive with their planning. At the very least, they would have to understand what goods and services tax is and the effect that it can have on their business. They also need to come up with a roadmap that will help them with the transitional phase as well as the future scenarios.

How will the small and medium enterprises benefit alongwith others?

From the point of view of sourcing, companies would be able to source from other states since there would not be any tax-related hassle. In fact, it could prove to be rather viable. The smaller suppliers and vendors could see more opportunities open up for them. They would also not have to pay countervailing duty or any other alternate form of duty, alongwith special additional duty. These are normally charged in customs duty.

The companies may have to change the way they procure and distribute goods as a result of the changes being made to the tax system. Now that there is excise duty being levied on manufacturing, it may no longer make sense to go through with the present arrangements for distributing finished goods. They might also have to review the present structure of product flows and network structure. They may have to alter their prices as well and this could affect their profitability as well.

Since they would be saving on taxes because of GST products would have to be re-priced as well. This means that they may need to review their price markups and margins as well. Goods and services tax would also improve their cash flow and bring down the costs of inventory since the tax would have to be paid when the goods are being supplied or sold rather than when they are being removed from the factory.