Info-Cafe

Results for : All categories

Results for : All categories

Difference Between Micro, Small and Medium Enterprises

Introduction to MSME

The term MSME stands for micro, small, and medium enterprises. Companies in India come segregated into the aforementioned groups. The classification is done based on their nature, turnover, and scale of investment. It is the MSME Act of 2006 that governs the same.

Furthermore, companies fall into two groups – services and manufacturing. Business owners these days register themselves as MSMEs in Udyam and NSIC (National Small Industries Corporation) and get the benefits provided by the Indian government for such companies. These steps are helping them grow by providing them the support that they need to such an extent. Most of the benefits offered are in the shape of policy steps and easy credit. The aim is to make sure that these businesses can grow properly.

The Types of MSMEs

The three types of MSME enterprise are available in India such as:

- Micro enterprises

- Small enterprises

- Medium enterprises

And further, the MSMEs are classified into two sectors as per their business nature such as:

- MSMEs into Manufacturing Industry

- MSMEs into Services Industry

As has been said already, MSMEs are categorized into two major groups – manufacturing and services. The manufacturing MSMEs are engaged in producing and manufacturing goods. It can be for any industry as long as specified in the first schedule of the Industries (Development and Regulation) Act, 1951. It could be for using machines and plant equipment as a part of the process of value addition.

The service-based MSMEs take part in rendering or providing services. They also have a properly defined investment in the equipment that they use.

What is a Micro Enterprise?

You can see micro-enterprises everywhere around you. It includes the likes of the ice cream parlour in your neighbourhood and the café near your college that you visit quite a lot. These are small businesses that have limited capital and very few people working for them.

Usually, a micro-enterprise would not hire more than ten people to work for it. As we have said already, the capital investment in micro ventures is minimal. In a developing country such as India, micro-enterprises represent the lion’s share of the business sector.

These companies add a lot of value to the economy of a country by creating jobs. They help people earn more money than they otherwise would have. They also lower the overall cost that is necessary to do business in India.

If you closely look at the entrepreneurs of India, you will see that most of them work in this particular stratum. The biggest reason is that they lack the extensive money necessary to start a big corporation straight off the bat.

What is a Small Enterprise?

Small enterprises are small businesses. They are also businesses that employ a limited number of people, and their turnover is likewise as well since they do not have the high volume of sales that the companies bigger than them have.

In technical terms, you can say that these companies are owned independently. Hence, they operate similarly. The thing with these companies is that they are limited in terms of their revenue and size. In this case, a lot depends on the industry growth and scale as well.

Most of the small businesses are sole proprietorships privately owned, partnerships, and one person company. Every industry in India has small enterprises. They have vast diversity in this respect, starting from convenience stores to smaller manufacturing plants. It could be the bakery in your locality that employs around ten people or a manufacturing unit with 50 people on its payroll.

Some other examples of such enterprises are illustrated below:

- Restaurants

- Dry cleaners

- Law firms

- Architectural and engineering firms

- Hotels

These enterprises also differ in terms of factors, such as size, regulatory authorization, and revenues, to name a few. In some of these small businesses, you need only a business license to do the work. An example of such a business would be a home-based accounting business.

In some other cases, small businesses have to deal with some specific regulations. Examples of such businesses include day-care centres, retirement homes, and orphanages.

What is a Medium Enterprise?

A medium company is primarily one that employs no more than 250 people. It is only when the small companies grow steadily and slowly that they become medium companies. Even as such a company earns more money it starts to save money that it needs to invest in various parts of its business such as technology, infrastructure/ buildings, recruiting and up-skilling more employees, and equipment. It eventually acts as a bridge between big corporations and small businesses.

The Difference between Micro, Small, and Medium Enterprises

The difference between the micro, small, and medium enterprises is in the total investment made in these enterprises and the turnover they get in a year. To make it clear, they are discussed as below:

Distinction of MSMEs in Terms of Investment and Annual Turnove

|

MSME Classification |

Micro Enterprises |

Small Enterprises |

Medium Enterprises |

|

Manufacturing and Services Enterprises |

Investment: Maximum Rs. 1 crore Turnover: Not more than Rs. 5 crore |

Investment: Maximum Rs. 10 crore Turnover: Not more than Rs. 50 crore |

Investment: Maximum Rs. 50 crore Turnover: Not more than Rs. 250 crore |

The Role Played by MSMEs in the Economy

As we have said already, micro, small, and medium enterprises are all around us. These include small outlets and stores in your neighbourhood and the bigger franchise stores and grocery store chains. They employ so many people around the country to work for them – they create jobs important in this day and age.

So, this is the contribution that they are making to the economy of India. Apart from that, they also pay taxes, which add to the money earned by the national government. Some of them earn revenue in foreign exchange as well.

Conclusion

The good thing with starting such a business is that you have a lot of help coming your way. For example, you have companies that help you with all the documentation and official procedures necessary for incorporating the same. We BusinessWindo can help you to overcome all the difficulties related to business matters like company formation, management and accounting services and also help you get the loan you need to get such a business off the ground.

------------------------------------------------------

Related Posts:

How to Get MSME Udyam Registration in Bangalore, Inida?

How to Get Food Business (FSSAI) License in Bangalore, India?

How to Get Export Import Code (IEC) License in Bangalore, India?

How to Get GST Registration for Your Buinsess in Bangalore, India?

How to Get Startup India Registration for Your Startup

What is a Startup?

A startup can be described as a business enterprise that has been newly established. They are generally small and started by a single or a group of a few closely knit individuals. One of the main ways in which the startup business is distinct is that it provides with a wholly new service or product which is not provided by anyone else in the market. Hence, the main theme of a start-up business centers on innovation or an innovative approach to things. The startup company creates a completely new product or service or modifies a currently existing product or service with the goal of coming up with something better.

In many cases, the startup companies come into existence when their founders and owners find the existing products and services within that category are really not up to the mark or can be improved. In other words, they intend to rectify the shortcomings of certain products and services or solve a problem and make sure that the end users have a better experience with them. Startups can also be developed when one of the founders and owners come up with an excellent idea for a service or product.

A major advantage of the startup companies is that they can provide employment opportunities for a lot of people. For this reason, the Indian government regularly encourages startup companies to thrive so that they can improve the lives of common people. The startups in India also play a critical role in improving the economy of the country.

Through the Startup India initiative, the startup business owners in India can come up with innovative solutions to life’s challenges and problems and also ensure economically sustainable development for the country.

What is Startup India?

Startup India functions as an important flagship initiative undertaken by the Indian Government. The main aim of this initiative is to promote a holistic environment for startup ventures to grow and prosper. This can not only give rise to a powerful ecosystem for innovative products and services but also encourage entrepreneurship across the business environment in India. This initiative came into practice from January 16th, 2016 and ever since then it has already given rise to numerous programs that are aimed at assisting the entrepreneurs so that new avenues of employment can be created for people in India.

The programs under Startup India are managed efficiently by a Startup India Team that is dedicated to help startup owners in India. The team reports directly to DPIIT or Department for Industrial Policy and Promotion.

What is Startup India Registration?

The method through which a startup business enterprise registers itself under the government initiative of Startup India is referred to as Startup India Registration.

Startup India Recognition Benefits

There are numerous important benefits of getting Startup India Recognition certificate. Let’s have a look at them.

Tax Exemption

One of the main benefits that any startup firm can have when it gets Startup India Recognition certificate is tax exemptions. This can offer the business enterprise to save on taxes for 3 years among the initial 10 years of inception. The startup business is also going to have tax exemption according to section 56 of Indian Income Tax Act, i.e. Angel Tax.

Patents

The startup companies are going to get about 80% discount during filing of patents. The Government will take care of the whole fees associated with the facilitators managing the patents, the specific designs or any kind of trademarks that these startup companies may choose to file. Startup companies only need to pay the money associated with the statutory fees required. Patent applications filed by these startup businesses are going to go through a quick examination in order to make sure that they are of value. A panel of facilitators is going to help the startup firm when they are looking to file the IP applications.

Self-Certification

Self-Certification compliance procedure can be performed for different kinds of environmental laws as well as labour laws. No inspections are going to be performed for the first 5 years for labour laws. Inspections are performed only in cases where there are detectable and accurate complaints of problems or violations that are filed in writing. These complaints also have to be checked and approved by an officer with more experience than the inspecting officer. When it comes to environmental laws, startup companies that fall within ‘white category’ can self-certify their compliance practices. Random checks can be performed for them in those cases.

Smooth Public Procurement Practices

The startup business enterprise is not required to have prior experience within the manufacturing and development sector. These companies are also not required to submit the Earnest Money Deposit and/or the bid security while filling government tenders. The owners of that startup venture can list their products on Government e-Marketplace which is a major online procurement site and the largest online marketplace for the Government Departments for procuring services and products.

Easy Winding Up

The startup ventures characterized by simple debt structures and also those that comply with definite income criteria can benefit from fast winding up of the enterprise within 90 days once they have applied for insolvency. In such an event, an insolvency case handler is going to be chosen who is going to be in complete charge of that company. This liquidator will handle swift closure of such a business, sell off all the assets, make sure that the creditors are repaid and keep up with distribution waterfall that is determined by the IBC.

Eligibility Criteria for Startup India Registration

The startup India scheme eligibility criteria described below must be observed by the startup ventures when they want to register with Startup India.

- The startup venture can only function as a limited liability partnership firm or a private limited firm.

- The enterprise must stay as a startup enterprise for the initial ten years after the official registration date. Recently the Indian government effectively changed this rule from seven to a decade for giving opportunities along with tax exemptions. As companies operate as startups for longer periods, they can have access to such benefits for a greater span of time.

- The business venture is going to stay a startup unless the yearly turnover doesn't go beyond Rs 100 crores within a single year within the first decade. Once the company achieves this goal, the company is no more a startup. This is a new rule and the Rs 100 crore clause is an upgrade from the initially decided Rs 25 crore mark.

- A startup venture should be effectively funded by an Angel Fund, a Private Equity Fund or an Incubation Fund.

- The enterprise must get the proper approval from the Department of Industrial Policy and Promotion (DIPP).

- The owners of the company must get recommendation letter written by an incubation entity.

- A patron guarantee has to be obtained from Indian Patent and Trademark office.

- The venture must come up with truly original schemes and ideas

- All the various details associated with the funding must be officially registered with Securities and Exchange Board of India or SEBI.

How to Register a Startup with Startup India

There are some steps that you have to follow when you are planning to register your own startup venture under Startup India. Have a look at these steps described below to learn all about such steps.

Here is the process for registering a company in Startup India:

Incorporating your Business

The first thing that you have to do is get your business venture incorporated as a Limited Liability Partnership or a Partnership firm or a Private Limited Company. You should follow all the essential practices meant for business registration such as obtaining Certificate of Incorporation or Partnership registration and other required documentation.

Registering with Startup India

You then need to register your startup venture with Startup India and this can be done online. You need to visit the official Startup India website and put in the various details related to your business on the online form there. You are going to get an OTP sent to your email inbox. Enter this OTP as well as other details for creating your own Startup India profile.

Once this has been done, you can send applications for incubator programs, acceleration programs, the mentoring programs and other topics on Startup India's website. You can also easily access the numerous resources such as the Government Schemes, pro-bono services, Learning programs, development programs and the state polices for the startup ventures.

Get DPIIT Recognition

After you have taken care of the profile creation process, it is important for you to get DPIIT Recognition. DPIIT stands as Department for Promotion of Industry and Internal Trade. When you get DPIIT Recognition, it is going to help you benefit from numerous resources and tools that are going to be good for you. For example, you can avail the best of intellectual Property resources and the associated services, obtain self-certification in accordance with environment as well as labour laws, get help from Fund of Funds, have lenient public procurement norms and also wind up your company easily if you ever need to do that. Other benefits include tax exemptions at different stages and other advantages.

Recognition Application

In the ‘Recognition Application Detail’ webpage, the startup venture owner must click on ‘View Details’ under the Registration Details section. This can show the ‘Startup Recognition Form’ that has to be filled up and duly submitted.

Documents for Registration

A number of essential documents are required for registration. These are listed below.

- Incorporation/Registration Certificate for the startup

- Details of all the Directors

- Proof for concepts like website link /pitch deck /video

- PAN Number

- Details on patent and trademark (Optional)

Recognition Number

Once you have sent the application through the website, it is going to provide you with a unique recognition number for your startup company. This certificate will be issued once the documents have been examined. It generally takes about 2 days from the submission for you to get it. Do not upload wrong/forged documents since that can lead to hefty fines.

How We Help You in Startup India Registration

If you are looking to sign up with Startup India Registration and you are not exactly sure as to how you should proceed, then you can rely on us as we can help you to manage the registration process quickly and accurately. At BusinessWindo, we have been offering Startup India Registration consultation services to startup owners regularly, making sure that startups of various types can benefit from the government regulations that are undertaken by the visionary ideas of our Prime Minister Mr. Narendra Modi. We have already helped many startups to grow and improve the economy of the country and we can do that for your startup business as well.

-------------------------------------------------------------------

Related Articles:

Professional Guide for Entering to Entrepreneurship

Steps to Setup a New Startup Company in Bangalore, India

How to Register a Company: Structure, Eligibility, Documents & Process

How to Get ISI Mark Registration Certificate in Bangalore India

The ISI (Indian Standards Institute) symbol stands for authentication. It is the seal of approval deemed to be necessary for verifying the products that are sold in India. The ISI mark can be described as a sign which indicates the fact that the product has been thoroughly scrutinized and has been checked to be of high quality. And thus, this product is safe and reliable for selling in the public domain.

The products that have the mark on them are ones that comply with the quality standards set by ISI. When you get this ISI mark certification for your products, you get the approval of the concerned authority to sell the products in the market and in the process think on expanding your business reach. As per rules and regulations, no product in India can be sold without the ISI mark on it.

Objectives of Indian Standards Institution (ISI)

The ISI was founded in the year 1947. Then it has given the new name as Bureau of Indian Standards (BIS). Means BIS is the head body for Indian standards of consumer and industrial products. The ISI mark is considered as a sub-domain of BIS.

The main objectives of ISI are to set the standards for product standard quality, durability and safety for consumers and industrial goods. It verifies each and every product’s standard and quality and grants ISI certification mark for that.

What are the Purposes of ISI Registration?

The main aim of ISI registration for your products in Bangalore is to assure your customers that your product is of good quality, reliable enough and long-lasting to use.

Obtaining ISI mark certificate for industrial goods/products help build trust and relationships with consumers. If producers want to get ISI mark license for their products, they’ve to adopt the standard and quality control procedures for their products as prescribed by the Bureau.

This in turn also makes them a lot more confident when it comes to buying your product. This sign also assures the consumers that using the product would not harm their health in any way.

Products that Involve Mandatory ISI Certification

These following products are under compulsory certification; for which you have to get an ISI mark certificate in Bangalore or anywhere in India:

- Cement

- Electrical motors

- Steel products

- Stainless steel plates

- Transformers

- Clinical thermometers

- Food products

- Packaged drinking water

- Cylinders, valves, and regulators

- Stoves

- Batteries

- Steel sheets and steel wires

- Capacitors

- Kitchen appliances

The Benefits of ISI Marked Certification

You get the following benefits when you obtain an ISI certificate for your products:

It increases the level of satisfaction that your clients have with your products.

However, customers can take legal action against products that have the ISI mark but are found to be of a low quality.

In case the customer feels that the product is of a low quality you – the seller of the product – have to exchange that product.

ISI mark helps the owners and manufacturers of the products to increase their business.

For the customers, this sign indicates that they are getting the best quality.

Documents Required Applying for ISI Mark Registration

The following documents are needed in order to apply for ISI registration:

- Registration certificate of the company

- Aadhaar card of company directors

- Property tax receipt

- voter ID card

- Insurance policy

- Driving license

- Rental agreement for rented properties

- Copy of test reports

- Telephone bill

- List of manufacturing machinery

- Electricity bill

- Copies of calibration certificates of testing equipment

- Bank statement

ISI Mark Registration Process

The process of registering for the ISI mark happens in certain definite steps.

In the first step, you have to select the right code for your product. You have to do this in accordance with the product quality as has been prescribed by ISI.

After that, you’ve to fill up the application form. This form is referred to as Form V. You have to provide all the necessary documents with the application form. Over here you also need to pay the fees for the inspection of your manufacturing premises and the certification.

Following this, the authorities will visit your premises. This happens only after you have been successful with the application procedure that involves submitting relevant documents related to your own business. The Indian government authorizes the people who make up the inspection team. They would come and look at your quality control processes as well as the factory premise. They would also take some samples of your product for purposes of testing in a lab that has been approved by BIS (Bureau of Indian Standards).

After this, you would have to collect the test report of the sample. You need to submit that report to BIS.

BIS would verify the testing report and your application form properly and then issue the registration certificate.

Time Required for Getting ISI Registration Certificate

Usually, for manufacturers based in India, it takes between 30 and 90 days to get the registration. This period is applicable following the date when you submitted the application form. If you are a foreign manufacturer it could take you between 90 and 120 days from the day you submitted the application.

How do We Help with ISI Registration?

BusinessWindo can provide you invaluable help with such applications. As one of the experienced companies helping businesses all throughout, we have a great track record and vast knowledge of the industry as well. We have helped plenty of businesses like you and you can be sure that our experts would be able to help you as well.

How to Succeed Your Business During Uncertain Times

Business firms go through a lot of ups and downs while dealing with volatile market conditions and other technical and strategic challenges within the enterprise. Experiencing uniform growth at all times is not practically possible and for this reason a company should have some workable methods in place that can help them to achieve steady success during the uncertain times.

With the global outbreak of COVID-19 pandemic, it has become even more important than ever before for companies to work on their strategies to cope up with difficult times. So that they can deal with market competition, make profits and support their working employees.

Here are seven actionable tips you can adopt in your business process when you are looking to achieve success with your business even with turbulent market conditions.

Rethink about customer experience

Your customers are the lifeline of your business and hence you should always focus on providing them with the best experience with your brand. However, difficult times need advanced remedial measures and you should rethink your customer experience when you want to obtain optimum returns from them. It is very important that you develop a strong sense of trust on your brand among your consumers so that they are always invested in what you have to offer.

Whether it is getting the customers excited about a specific product, encouraging them to make the purchase and then sharing their thoughts on social media, you should guide them smartly to ensure a positive experience. You should also make use of innovative tools and strategies to perform market research and learn about your target customers. This data can enable you to boost your sales figures. You can also benefit from greater conversion rates in this way. Strategic maneuvering of customer experience can guarantee you their loyalty which is even more important than a single sale.

Embrace digital way

Digital transformation is the way to go when you are looking to improve the operational efficiency of your business on multiple levels. When you replace your old methods of managing company information, sales records and other details, you can improve the efficiency of your business and also make better use of your financial resources.

Digital tools and software systems can enable you to coordinate with your employees in a better way and also maintain accuracy at each and every step. Tasks like handling of projects, doing market research, keeping track of customer information, managing sales records, tracking inventories and planning of resources becomes much simpler when you embrace the digital way.

Support workforce with agile operation

Your workforce needs to have the strength and flexibility. Aligning your organization with agile workforce delivers better performance under critical conditions. It is important that you have training modules in place to educate your working employees to move quickly and easily when they need to upgrade themselves and learn about latest technological tools and software applications.

Apart from providing them with instructions on advanced technology like cloud computing, IoT, SaaS, machine learning, data science and artificial intelligence, you should also teach your workforce to have a flexible approach in their work so that they can adapt to change quickly.

Change and evolution is a constant thing in the business world and unless they are always prepared to adapt efficiently, it will be difficult for them to improve their professional expertise and help your company to grow and prosper. You should also motivate them with employee rewards programs so that they feel encouraged to improve their performance.

Improve customer service

Customer service key plays a critical role in handling customer queries, doubts, concerns and worries. In today’s world where a lot of business activities are managed online and customers hardly interact with a human face, it is important for them to have someone whom they can reach out when they want to get their issues sorted out.

It is vitally important that you have a well trained and skilled customer service team that can offer complete support to your customers any time they choose to get in touch with you. A lot depends on your customer support when you are looking to retain your old customers and get new ones. Whether you decide to have an external team of customer service and hire a company to take care of that or have an inside team, getting the best customer support team is vital to your long term success.

Diversify your products and services

Product or service diversification is one of the key strategies that you will need to work on when you are looking to survive the business competition, especially in troubled times. Yes, it does involve a considerable degree of risk. However, unless you diversify you won’t be able to appeal to a wider segment of consumers. Moreover, the scope of your brand is going to be seriously limited when you have only a few types of products to offer. The same also goes for the services that your brand has to provide.

Communicate clearly

Lack of communication or faulty communication can further complicate an already problematic situation. A clear and concise communication is essential in customer service to build good relationships of business. It is therefore very important that you have all of your team members on board; so that they are fully updated on any company strategy or move. This can help them to contribute in their own ways, so that your company can deal with pressure situations in a better way. It can also make it possible for them to avoid errors of judgment.

Double down innovation

When things are tough, you should double down innovation and wait for better times to experiment with new ideas. This is because development and innovation requires taking chances. While they always involve some risk, things become even riskier when you have to deal with a critical market condition or a situation where things are already rough. It is necessary that you have maximum resources at hand so that you can deal with any crisis smartly.

These are the most of the key working methods greatly effective for businesses in crisis. You can implement these techniques when you are looking to achieve success with your business even during uncertain times.

How to Close Private Limited Company in India

The process of company closure is also referred to as PVT Ltd company closure or strike off. In India, such work is done as per the rules of the Companies (Removal of Names of Companies) Rules, 2016. It is administered by Section 248 of the Companies Act, 2013. So, if you want to close private limited company in Bangalore, this is what you have to follow. Experts would advise you that if you are not running your company you should simply close it off.

How can you close a private company in India?

The process of closing a private limited company has to be done by filing with the Form STK 2.

Previously, Form FTE was being used for the purpose of company closure. But nowadays, you would have to apply it through STK Form. You also need to pay a government fee for the purpose. At present this fee is 10000 rupees. However, it can always change in the future. This is why it would be better if you could check out the latest figure in that regard.

There are a few steps that have to be filed in this regard:

First of all, you have to pay off all your liabilities that you have in your business.

Once you have paid off your dues, you would have to get a No Objection Certificate (NOC) from them. However, if you are yet to start your business or operations as such this clause would not be applicable for you.

In the second step, you would need 75 per cent consent. This is one of the new requirements that have come up in this regard. This means that in order to wind up your company, you would need the consent of 75 per cent of the members and shareholders of your company. Furthermore, one director has to come forward and take all the responsibility for the closure of the company.

Once you have gotten the consent, you would have to prepare the application. You would have to file it with ROC (Registrar of Companies). During filing the application, there are some necessary documents have to be submitted along with it, that are mentioned in below.

When can a company apply for the closure?

Business owners can apply for closing of a company while these issues take place:

You (legal directors) can apply for closure if you have not started doing business within a year of incorporating the company.

In case, if you have not done any business in the past couple of financial years and have also not asked for the status of a dormant company as per Section 455 of the Act, you can apply for closure as well.

What documents are needed for closing a private company?

There are two types of documents that are needed in this case – mandatory and optional. The mandatory documents may be enumerated as below:

- Indemnity bond that has been notarized by the directors

- Affidavit in the shape of Form STK 4

- The latest statement of accounts

- Consent of 75 per cent of the members or a special resolution from them

- A statement of accounts that contains information on the liabilities and assets of the company – it should be audited by a chartered accountant

The optional documents are PAN (Permanent Account Number) card of the company as well as certificates of closing the bank account. The companies that offer such services normally need you to provide them in scanned formats.

What is the process for company closure?

There are three kinds of winding up of a company –

- Mandatory;

- Voluntary; and

- Winding up a defunct company;

In mandatory, winding up a company would have to file a petition for closure.

This can also be done by the following:

- Contributors to your company

- ROC

- Trade creditors

- State or central government

All the documents that you supply with the petition would have to be audited by a chartered accountant, who is practicing presently. The auditor would have to provide an unqualified financial statement.

You would have to advertise the petition for two consecutive weeks. The advertisement needs to be in the regional language of the area where you are doing the business as well as in English. You would have to submit Form 11 in this case. You need to submit some important documents in this case such as fully audited books of your accounts. This has to be done till the date when you are making the application.

If you are looking for voluntary winding up, you would have to pass a board resolution in accordance with the Companies Act 2013. You need to make sure that most directors of your company have agreed to the winding up.

In these cases, you also need a special resolution where 75 per cent of the shareholders have to vote in favour of closing the company. You also need the trade creditors to approve this act of winding up the company.

If your company is defunct or dormant, you would have to follow an advanced process. Here you would have to submit the STK-2 form. This particular form has to be filled up by ROC. The director of the company would also have to approve of the same. However, she or he has to be supported by the board so that she or he can perform such an action.

Expert help on company closing

There are many companies in Bangalore that can help you in this regard. But BusinessWindo is something different from them. We can audit, draft your documents and get your signature as well. This takes around a week to be completed. After this, we would proceed for the closure. After that we would file for closing the company. The ROC would approve of the same and send a notice to you as well. This would take around 3 months to be accomplished.

In the final stages, the company name would be struck off from the records once there is no objection in a 6 to 8-month period after you have received the ROC notice.

----------------------------------------

Read More Related Resources:

How to Start a Startup in Bangalore?

How to Register a Company in Bangalore India?

How to Start PMS (Portfolio Management Services) Business in India?

How to Get Drug License in Bangalore India

As per the Drugs and Cosmetics Act, 1940; if you wish to manufacture or sale Ayurvedic, cosmetic, and allopathic drugs or products you would need a manufacturing or sales license. It is the State Licensing Authority that issues the various licenses in this regard and monitors them as well.

To get drug license in Bangalore for retail or wholesale, the applicant/ entity has to apply with the specific authority along with proper documentation and process ensure to obtain the license certificate.

The most prominent ones among these are Drugs Sales License and Drugs Manufacturing License for Ayurvedic, Allopathic and Cosmetics. These offices also perform a number of other functions such as inspecting the sales premises and the drug manufacturing units on a regular basis. They also implement the Food & Drug Act in order to make sure that there is no malpractice in this regard.

It obviously goes without saying that the biggest part of this work has to be done by these offices which issue the manufacturers’ licenses as per the provisions of the Drugs Act.

What other licenses does the state authority issue?

Karnataka State Licensing Authority that also issues the manufacturing licenses for the following entities:

- Blood banks

- Blood components

- Blood products

- Large volume parenterals

- Large volume sera

- Vaccines

However, in these cases the approval of the Central Licensing Authority is necessary as well. In this case we are referring to the Drugs Controller General India, whose headquartered is situated at New Delhi.

In such cases the Central Drugs Standard Control Organization and the State Drug Control carry out joint inspection of the premises where the manufacturing work will be done.

Licenses need to acquire for pharmaceutical products in Indian market

The Drug and Cosmetic Act makes it mandatory for you to receive a number of licenses so that you are able to manufacture Ayurvedic, Allopathic and Cosmetic products in India. They tend to vary.

However, a brief idea in this case can be had as well. License on Form 32 is issued for manufacturing, selling, and distributing cosmetic products. For this you would have to sign Form 31. When you get License on Form 32A you can take loans for making, selling, and distributing cosmetic products.

If you wish to start a lab where the manufacturers of cosmetics and drugs can get their raw materials and final products tested before selling and distributing them you would need the License on Form 37.

For this you would have to fill up and submit Form 36. In fact, this same process needs to be followed in order to renew this approval.

What are the requirements in these cases?

As you would know already, you would receive your drug manufacturing license from the state licensing authority. As a maker you would need to make sure your production is being overseen and done by technical staff members who are qualified to do such work in the first place. It is very important that at least one of your technical staff members has the following qualifications:

- Diploma in pharmacy that has been approved by the Pharmacy Council of India as per the Pharmacy Act, 1948; or

- She or he should have passed the intermediate examination with chemistry being one of the subjects or any other examination that is deemed to be an equal of the same by the licensing authority; or

- He/ she has to be registered under the Pharmacy Act, 1948

What are the documents required for drug license?

If you want a cosmetic license that allows you to make and sell such products in India you would need to produce the following documents:

- Application forms

- A certified copy of the proof of constitution in your form

- Challan of fee deposited

- Affidavit of non-conviction of proprietor, partners, or directors of the company as per the Drug Act 1940

- Declaration form

- Certified copy of Registration Certificate of the local pharmacy council or Experience Certificate of the Registered Pharmacist or competent person along with qualification certificates

- Blueprint of key plan

- Bio-data form

- Blueprint of site plan

- Affidavit of registered pharmacist or competent person with respect to fulltime working of the firm – this should be attested duly by a notary

- Basis of possession of premises

- Appointment letter of registered pharmacist or competent person in charge if in case she or he is employed by the firm

- Proof of ownership of premises if it not rented

Drug license application process

Here’s the steps need to be followed to get the drug license:

- Preparation of documentation

- Submission of application

- Inspector visiting the premises

- Scrutiny and inspection

- Issue or grant of license

In order to get the approval of drug license from the regulatory bodies it is rather important to follow what constitutes good manufacturing processes. Depending on the kind of products that you wish to manufacture or sale – such as drugs, cosmetics, and herbal products – you would have to file a separate application form with the issuing authority. You also need to file the application in its prescribed format.

After this a Senior Inspector, under instructions from the State Licensing Authority, would visit your business premises and submit a report on the basis of what she or he has seen.

After this the report would be received by the higher authorities and they would scrutinize the same. It is on the basis of this scrutiny that your application would either be accepted or rejected.

If your application is accepted, then you’ll get a license certificate. Else you’ve to neatly follow the mentioned rules and regulations of drug license process advised by the authorities.

Once you get the drug license, you can apply for more items to be endorsed in your license. A similar process would be followed in that case as well. If you wish to get approval as a testing laboratory where the manufacturers would carry out their analyses and tests you would be subjected to a joint inspection by drug inspectors from both the state and the central bodies.

As may be expected in a process that is as detailed as these you would have to fill up a number of forms and submit them in order to get the license.

How our experts can help you in this regard?

These days, you can find there are number of companies in such regards, but BusinessWindo is different from them. We have people who are skilled and trained in doing such work in the first place. And our professionals are also highly experienced in this regard – today we have been here as we’ve done that a number of occasions and you can be sure that we would be able to help you fulfill your dream of obtaining drug license in India as well.

-------------------------------------------------------

Read More Helpful Articles:

How to Get PSARA License in Bangalore?

How to Obtain Trade License in Bangalore?

How to Do MSME Registration in Bangalore India?

How to Get Shop & Establishment License in Bangalore?

How to Register for ISO Certification in Bangalore India?

How to Start Import Export Business & Get Certificate in Bangalore?

How to Claim GST Refund in Bangalore India

GST (Goods and Services Tax) refund can be defined as the excess money that you have paid with respect to your tax liabilities in this regard. As per GST rules and regulations this process has been standardized so as to avoid any confusion in this particular regard. The process can be completed online and there is also a definite time period that has been determined for the same. If you want to know how I can get my GST refund read on and know more.

Who can claim GST refund?

All dealers who have registered for GST can claim refunds in this case. A registered dealer who is supposed to pay the tax as per RCM (Reverse Change Mechanism) can file for the refund as well.

Similarly, an ecommerce operator who is supposed to pay and collect TCS (Tax Collected at Source) can claim a refund. Dealers who deduct TDS (Taxes Deducted at Source) can be included in this group too. Dealers who export or whose work is deemed an export under GST rules can claim refund or rebate for their goods and services.

Embassies and bodies under the aegis of UN (United Nations) can claim refund for the tax they have paid on various purchases. International tourists can claim tax refund as well. If you wish to know how to claim GST refund in Bangalore these are things that you need to know.

When can the refund be claimed?

There are several cases where you can claim a refund on your GST payment. Normally, you can do so when you have made excess payment of tax because of an omission or mistake.

If you have accumulated ITC (Input Tax Credit) being the output is either nil rated or exempted from taxation. You can also claim these refunds once your provisional assessment has been finalized. If you wish to apply GST refund in Bangalore you need to know this as well.

What is the time limit for claiming the tax refund?

You can claim a GST refund within 2 years of having made the payment starting from a relevant date.

You need to remember that the relevant date in this regard tends to differ with respect to the cause for which the refund is being claimed. Following are the relevant dates for some kinds of cases:

- Extra payment of GST – date when the payment was made

- Export or deemed export of goods and services – date of despatch, passing the frontier, or loading

- Accumulation of ITC because output is nil rated or tax exempt – last date of the financial year of said credit

- Finalization of provisional assessment – date on which the tax has been adjusted

In case there is a delay in paying your refund you would receive an interest of 24 per cent per year on the same.

Documents needed to get GST refund

The following documents need to be furnished in order to claim GST refunds:

In case of exports:

- Invoice of transaction

- Statement that contains the date and the number of shipping bills or bills of export, and the date and the number of relevant export invoices

- Tax invoices

- Relevant bank realization certificates that show receipt of payment in foreign currency

In case of supply to SEZ (Special Economic Zone):

- An endorsement from the Proper Officer that shows receipt of such goods and services by the SEZ

- Tax invoice

- Declaration from the SEZ unit that they have not received ITC for the tax that the supplier has paid

In case of accumulated ITC:

- A statement that contains invoice details as has been stated in GST refund rules

In case of refund on account of judgment or order of a court or an appellate authority:

- Reference number of the order that has given rise to the refund

- Relevant tax invoices

How to claim GST refund?

As you know, you need to do it on online portal of GST and file the refund application in the form RFD-01 within 2 years of the date that is deemed relevant in your case. The form also needs to be certified by a CA (Chartered Accountant).

The process of claiming GST refund

Here are the steps you need to follow on for GST refund application process:

In the first step you would need to log on to the GST portal. After that you would have to follow this path – Services > Refund > Application for Refund. After this you would have to choose Refund of Excess Balance in Electronic Cash Ledger. After this you have to click on Create. Once you have clicked that button a screen will appear.

This screen will reflect all the balances in the Electronic Cash Ledger. You can claim them as refund. There is an editable table here named Refund Claimed. You can enter the refund values over here as well.

After this you would have to select the bank account where you would want the refund to be credited. This needs to be done from a drop down menu. Once this is done you need to click on Save. After this you would have to click on the checkbox that is located in the declaration section. A drop down would come and from there you would have to choose the Authorized Signatory.

On the basis of the kind of organization that you are, you would need to click on Submit with DSC or Submit with EVC. DSC stands for Digital Signature Certificate and EVC stands for Electronic Verification Code. Once you have filed the form you would receive the Refund ARN (Application Reference Number) Receipt. This would be generated in the PDF (Portable Document Format) format. A GST officer would perform the necessary inspections and the money would be credited to your account.

---------------------------------------------------

Read On More:

How to Do GST Registration in Bangalore?

How to Cancel GST Registration in Bangalore & Why?

There are some specific reasons as to why you can cancel the registration granted to you under GST (goods and services tax). The GST cancellation process in India can be started either by the department or by you.

In case of the department they can do so out of their own motion.

In case you – the registered person – have passed away your heirs can apply for cancellation.

If the department has cancelled your registration there is a provision that allows the cancellation to be revoked.

When you have cancelled your registration you would have to file a return. This is referred to as the final return.

So before going to cancel the registration, the taxpayer or the business owners should know the factors, understand the process and clear about the conclusion part, and then can proceed for this. To make the completed the work, hire GST consultant so they can direct you the right way and solve the problem.

What are the reasons for cancellation?

There is many reason to cancel GST registration. They may be enumerated as below:

- It could be that you are registered under other existing laws and are thus not liable to be registered under GST

- It could be that you have stopped doing the business

- It could be that business owner has died and that is why the business has been fully transferred, merged with another business, demerged, or disposed of otherwise

- It could be that the business is not meeting the threshold limit

- It could be that a taxable person is no longer liable to be registered under the GST – please note that this does not include people who have registered voluntarily for GST under Sub section (3) of Section 25 of the CGST (central goods and services tax) Act, 2017

- It could be that you have flouted the provisions and rules of the GST Act

- It could be that you, who has been paying tax as per composition, have not provided returns for three straight tax periods

- You are a registered person and not paying tax under composition levy – it could be that you have not provided returns for 6 straight months

- It may be that even after registering voluntarily you have not started your business from a period of 6 months starting from the date when you were registered

- It may be that you have obtained registration by way of fraud and intentionally suppressing or misrepresenting facts

What can be the results of cancellation?

If you cancel your GST registration you would not be needed to pay the tax anymore. In case of some businesses it is obligatory to register under GST. However, even if you cancel your registration and continue with that business it would be regarded as offence as per the rules and regulations of GST.

As a result you would have to pay some heavy fines for sure.

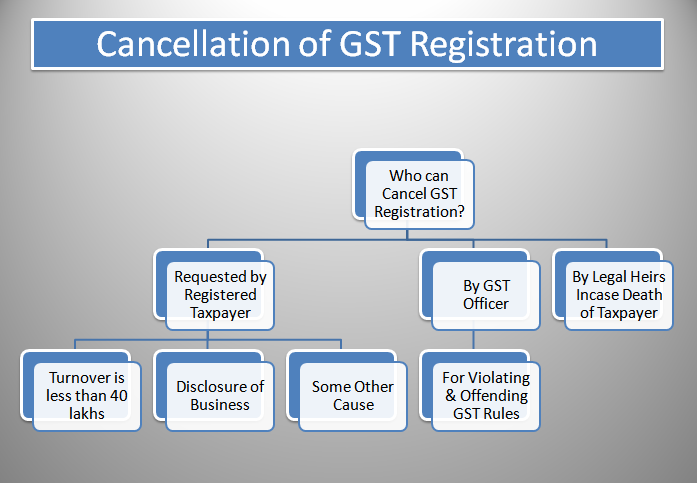

Who can cancel the GST registration?

You as the registered tax payer can request for the GST registration to be cancelled. There are various causes for which this can be done as has been stated above.

You can also do this in case your yearly turnover is less than the prescribed limit. It can also be done by the tax officer on some grounds. In case business registered person has got dead, his/her heirs can request for the same to be cancelled as well.

GST cancellation process

See the following process has to be required to get done the cancellation:

- Preparation of particulars for application

- File application through online

- Generate ARN during application

- Wait for show causes

- Satisfactory reply to show cause

- You’ll be asked to clear all unpaid taxes

- Review by GST officer

- Permission for grant of cancellation

In order to cancel the registration you need to know how to cancel GST registration. If you are already registered under existing tax laws such as central excise, service tax, and VAT (value added tax) but are not liable to be registered under GST you have to first submit an application.

This has to be done electronically within a certain date by way of the Form GST REG-29 at the official portal for cancellation. The registration would be cancelled by the Superintendent of Central Tax after conducting the required enquiry.

If you have registered under SGST (state goods and services tax) or UTGST (union territory goods and services tax) your cancellation would be done as per the process mentioned in the CGST.

If the superintendent feels that your registration should be cancelled you would be notified of the same by way of the Form GST REG-17.

You would be asked to show cause as to why your registration should be cancelled. This needs to be done within a period of 7 days starting from the date the notice was issued. If your answer is found to be a satisfactory one the officer would drop the motion and pass the order in the shape of the Form GST REG-20.

However, if your answer is not a satisfactory, one officer would reject the cancel of registration at a date that she or he deems to be fit. In this case you would be asked to clear all unpaid taxes, penalty, and interest within the due date.

In case you have applied for cancellation of registration by yourself and are indeed found to be not liable to be registered under the tax or fit enough for cancellation of registration the officer in question would issue an order. This would be done by way of the Form GST REG-19.

This would be done within a period of 30 days of you making the application. In this case you would have to pay a certain amount.

The payment would have to be made by way of electronic cash ledger or electronic credit ledger. The amount would be decided on the basis of the credit of input tax or output tax for any of the following:

- Stock

- Capital goods

- Plant and machines

The most valuable among these would be taken into consideration. The time period in this case is the date immediately before the cancellation.

In case you are paying on the basis of capital goods and plant & machinery you would have to pay an amount that is equal to the input tax credit that you have availed on the same. However, reductions are also applicable in these cases. This would be done on the basis of percentage points that have been prescribed. The other amount that comes into consideration in this regard is the tax that is to be imposed on the transaction value of these items – this would be done in accordance with Section 15. The higher amount in this case would be taken into consideration.

Even if you have cancelled the registration you are still liable to pay the taxes and other dues that you are yet to pay from the time when your registration was active. In this case the dues could be determined after cancellation as well.

Final return regarding the cancellation

When your registration has been cancelled you would have to submit the final return. This needs to be done within 3 months from either date when the order of cancellation was issued or when the actual cancellation happened. The later date would be applicable in this case.

You would need to do this electronically by way of the Form GSTR-10. This can be done on the official portal or by way of a facilitation centre that the commissioner has notified you about. The only exceptions to this norm are an Input Service Distributor, a non resident taxable person, and a person who is paying tax as per the Composition Scheme or TDS (tax deducted at source) or TCS (tax collected at source).

Revocation of GST cancellation

It could be that your registration has been cancelled by the superintendent on her or his own and not because of an application made by you. In that case you can make an application for the cancellation to be revoked. This can be done in the shape of the Form GST REG-21. In this case you need to make the application to the deputy or assistant commissioners of central tax. This needs to be done within a period of 30 days from the date that the order of registration cancellation was served. There are two ways to do it.

- You can do it directly at the official portal or

- Indirectly at a facilitation centre that has been suggested to you by the commissioner;

It could be that your registration has been cancelled because you did not provide the necessary number of tax returns. In that case you would have to provide the pending returns first and then file for revocation of cancellation. You also need to pay your unpaid taxes, penalties, interests, and fines – if any – in that particular regard. In case the officers find that your application is justifiable enough and that there are enough grounds for your cancellation to be revoked they would do so.

This would be done by way of the Form GST REG-22. It would be issued within a period of 30 days of having received your application and you would be informed of the same as well. However, if they find your application to be unsatisfactory you would be issued a notice whereby you would be asked to show causes as to why your application should not be rejected. This would be done by way of the Form GST REG-23. You would need to provide the reply within 7 working days in the shape of the Form GST REG-24.

In case your clarification information is good enough the officer would follow the process as in Form 22. However, if it’s not then your application would be rejected and the Form GST REG-05 would be issued. You would be informed of the same. The process for revocation is the same across all categories of GST.

Cancel registration by expert help and support

If you want cancellation of GST registration in Bangalore; you need to get the expert help & support to cancel registration for sure of effective on time. For this case, it is better to get expert and professional help in these matters because they can get the job done much better than what you may have managed by yourself for sure. So, we can fix your all issues related to GST matter timely.

PSARA License in Bangalore

Private Security Agency Regulation Act (PSARA) License

We want to clear you the things. Before going to start a private security agency in Bangalore or any other cities in India; the owner should have to choose a business type and register this with the concerned Registrar department.

After this, you can proceed for PSARA license and other essential registrations (such as shop & establishment, MSME, employee provident fund, ESI, professional tax, GST, etc.) regarding this matter.

See what are the significant things required for a private security agency to make the organization trustworthy and more cohesive during its journey.

- Register your business name first (you can wish to start with a sole proprietorship, partnership, LLP, OPC, Pvt Ltd)

- Apply your business name for PSARA license (see below the application process of private security license)

- Sign MOU with Training Institute

- Register your business to local Municipal Corporation under shops & establishment Act

- Register to PF (Provident Fund)

- Register to ESI (Employee State Insurance)

- Register for PT (Professional Tax)

- Register to MSME Act (Udyog Aadhaar registration certificate)

- Register to GST (if it is required for you)

So, here you can know more about PSARA license

What is PSARA?

The term PSARA stands for Private Security Agency Regulation Act. It is something that you need before you start a private security business here in India. A private security agency is one that is supposed to provide private security guards and various other related services to establishments that hire their services.

They are supposed to act as alternates to the local police. It is the Private Security Agencies Regulation Act, 2005 – also known commonly as PSARA Rule 2005 – that takes care of the working of private security agencies here in India. After the PSARA Act was enacted it has now become obligatory for all such businesses to get a license from the concerned state level controlling authority for such work.

What are the advantages of PSARA license?

One of the biggest benefits of the PSARA License for Private Security Agency is that your business gets the credibility that it needs in order to succeed in a market that is as competitive as India. As such, security happens to be a rather serious issue and one can only trust service providers who have the necessary approval from the government to do such work.

Thus, when you get such a license it increases the levels of your business credibility at each and every step of the way. Apart from that you are also able to function smoothly when you have the license as well. This is because once you get such a license you can rest assured till the time you have to renew it.

The 5 most important benefits of PSARA license certificate:

- License is an official authorization through this an agency or organization can serve to others

- It empowers the organization to provide security services to other organization

- The services received by the organization from you can keep a better trust on you

- Increases your credibility in the market to make safety their security system

- It allows the agencies to function smoothly in their field

What are the eligibility criteria regarding PSARA?

At a very basic level, any Indian company can apply to get PSARA license in Bangalore Karnataka or anywhere else in India for that matter. The same is also applicable for firms as well as association of persons. If the applicant happens to be a company the majority shareholder has to be an Indian. Apart from these there are also some other conditions which have to be satisfied. The applicant company or person should not have been convicted of any offence with regards to promoting, managing, or forming the company.

In general, the applicant person or company should not have been convicted of an offence where the prescribed punishment is imprisonment for a minimum of 2 years. The company or person in question should also not have any links to any association or organization that may have been banned under any law in India because of activities that posed any threat to the public order or national security of India. If the applicant is an individual she or he should not have been expelled or dismissed from government service on accounts of moral turpitude or misconduct as such.

What are the documents required in regard to PSARA registration?

The following documents are needed in order to get the PSARA license:

- Certificate of Incorporation and MOA (Memorandum of Association)

- A couple of photographs of the promoters

- Proof of registered office

- PAN (Permanent Account Number) Card of each of the promoters

- Signed MOU (Memorandum of Understanding) with a training institute

- Address and identity proof of directors

- Identity documents of the security guards

- ITR (Income Tax Return) copy of each director

- Registration with service tax department

- PF (Provident Fund) registration

- ESI (Employees State Insurance) registration

- Registration certificate of establishment under Shops & Establishment Act

- Registration under Contractual Labour Act

- Affidavit as per PSARA Act

- Affidavit of security training

- Logo of security agency

- Detailed armed licenses

- Character verification certificate of the employees

- Uniform pattern

What is the process for getting the PSARA license?

For getting registration certificate of private security agency under PSARA Rules, 2005 and 2008; the parties have to meet the eligible criteria, documents and follow these essential procedural steps.

Step 1: Preparation of Documentation on PSARA license

Step 2: Filing PSARA application in Department on Behalf of You

Step 3: Go Through Follow Up With State PSARA Department

Step 4: Application Goes for Verification to Controlling Authorities

Step 5: Getting NOC from Concerned Police Authorities

Step 6: Signing MOU with State Training Institute

Step 7: Getting Grant of License

The first step that you need to take when you’re applying for the PSARA license is to check the entire document that you are submitting with your application. You need to gather them, notarize them, and submit them in the prescribed format as well.

In the next step you need to sign an MOU with a training institute. This needs to be done for your guards as well as supervisors. You also need to keep in mind that the training institute should be a recognized one. In every state you would get security training institutes that have the necessary recognition that allows them to impart such training in the first place.

In the third stage you would have to go for antecedents verification. In this case you would have to file the necessary details in Form-1. In case the applicant is a firm, an association of persons or a company each proprietor would have to file a separate verification form.

This is also applicable for the majority shareholders, directors, or partners with regards to the type of company. After this you would have to file your application with the necessary documents at the controlling authority in your state. After this the application would be processed for the purpose of verification. Once the concerned police authorities have provided the NOC (no objection certificate) the controlling authority would either grant the license or reject the application. In case of rejection a definite reason would be provided as well.

It takes a total of 60 days for the process to be completed and it starts from the date that you applied for the license. You can apply to work at 5 districts in a state at the most at a time. However, you need to keep in mind that the application process is different with respect to each state. There are also certain conditions that have to be fulfilled in this particular regard. As per rules and regulations of PSARA you would have to employ supervisors in order to monitor how well the security guards are working.

You also need to provide the skills and training that the supervisors need in order to do their work the right way. You should ideally prefer people who have served for at least 3 years in the armed forces of India for the work of supervisors. The Act also mentions the criteria for disqualification and qualification of the security guards. You need to adhere to them as well.

How long is the PSARA license valid?

The PSARA license is valid initially for a period of 5 years. However, you can always renew the same for a period of 5 years by paying the necessary fees.

What are the prescribed fees for getting such a license?

If you are a private security agency that is operating in just one district, you would have to pay a fee of INR 5000. In case you are operating in between 2 and 5 districts, you would have to pay INR 10,000. In case you are working in an entire state, you would have to pay INR 25,000 as government fee.

----------------------------------------

Related Posts:

Get ISO Certification in Bangalore, India

Procedure to Get ISI Mark Registration Certificate in Bangalore, India

How to Get Trade License in Bangalore, Karnataka?

How to Apply for Trademark Registration in Bangalore?

GST Registration in Bangalore: Eligibility, Requirements & Process

How to Get Shop & Establishment License in Bangalore, Karnataka

Get FSSAI License for Your Food Business in Bangalore, India

Get Import Export Code Registration for Your Business in Bangalore, India